September 2016 Auckland Property Market Commentary

Independent market commentary courtesy of Ian Mitchell, Director, Livingston & Associates

Auckland’s commercial and industrial property markets have continued their strong gains over the last year.

An overview of the key sectors within the market includes:

- Central Auckland’s office market is experiencing strong growth in performance driven by increasing tenant demand, falling vacancy rates and ongoing rental growth. Pent-up tenant demand for good quality space is resulting in increased development activity. There is now over 100,000 square metres of office space under construction. Suburban office market’s performance has improved during 2016 with vacancy rates falling in most precincts. To some extent the lack of good quality vacant space within the CBD has encouraged tenants to consider options in other locations. Positive net absorption combined with moderate level of development activity resulted in overall suburban office building vacancy rates falling by approximately 1.5% over the last 12 months. Development activity is also increasing in the suburban precincts with over 65,000 square metres of space under construction.

- The industrial building investment market continues to provide robust returns supported by low interest rates, strong tenant demand, low vacancy rates and growth in rental rates. The uptake in space has been limited by the amount of stock available for lease rather than a lack of demand. Strong growth in tenant and owner occupier demand combined with declining amount of vacant developable sites has resulted in upward pressure on land values. Mixed use zone sites are increasing being purchased by investors looking at redeveloping them into residential which is placing further pressure on the existing stock of industrial properties. Higher land values combined with escalating construction costs is placing upward pressure on design build rents.

- The retail property market has continued to improve during the first nine months of 2016. Good quality vacant retail space is difficult to find for prospective tenants. Retailers’ sales volumes have increase although margins remain tight. Annual retail sales increased by 9.5% in the June 2016 year however consumer confidence fell to its lowest level in four years. The decline in the number of unemployed, low wage growth and poor housing affordability appear to be weighing on consumers’ outlook. On the positive side, growth in house values has increased household wealth and combined with low interests and strong population growth have supported the growth in total household spending which has benefited the retail sector.

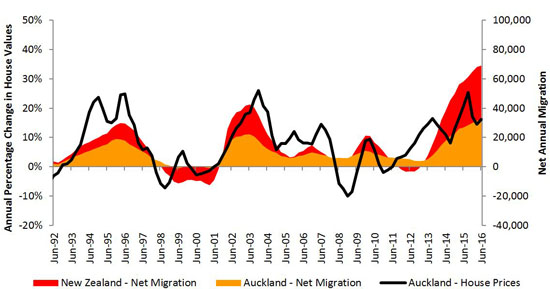

Figure 1: Net Overseas Migration and House Value Growth

The economy is expected to continue to expand over the next five years with growth driven by low interest rates, high rates of population growth support by net migration gains, increased levels of construction and retail activity underpinned by population growth, growth in the tourism sector and slowly recovering commodity prices. Auckland region is expected to continue to be one of the fastest growing regions in the country with growth primarily supported by population growth of in excess of 3% per annum. There is growing unease over the unaffordability of Auckland’s housing stock and the long term implications it may have on the sustainability of the region’s economy.

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property Market Indicators

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Down | Down | Steady at low levels | Down | Steady at low levels |

Flat |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Steady |

Short term outlook is for current market conditions to continue as Auckland’s strong regional economy continues to grow demand from the occupier market.

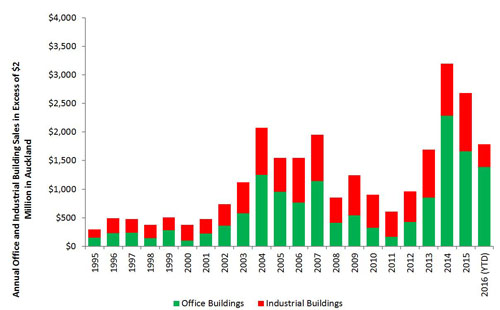

Figure 2: Commercial and Industrial Building Sales (properties selling for more than $2m in Auckland)

The volume of sales during 2015 was down from the peak in 2014 and whilst the sales in the 2016 year to date reflect robust activity they are also at levels less than the peak in 2014.

The volume of sales is limited by a lack of stock rather than investor demand or access to credit.

Sales during 2016 will increase as more transactions are settled.

The lack of good quality investment stock has resulted is some potential buyers considering markets outside Auckland. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 5.00% to 7.50% |

5.00% to 7.50% |

Steady | Strong | |

| Office | 6.00% to 7.00% | 6.75% to 7.50% |

Steady | Strong | |

| Industrial | 5.75% to 6.50% |

6.25% to 7.00% | Steady | Strong | |

Investor demand in the three sub markets has continued to outstrip the supply of buildings available for sale.

Low interest rates and readily available credit are underpinning investor demand at current levels of return.

Current yields demonstrate the strong competitive nature of the current market and perhaps do not always reflect the level of risk associated with individual transactions particularly for low valued properties.

Please note: Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.