Rental yield on the way up

Find out more about how the current decrease in interest rates may result in some extra cash in your pocket.

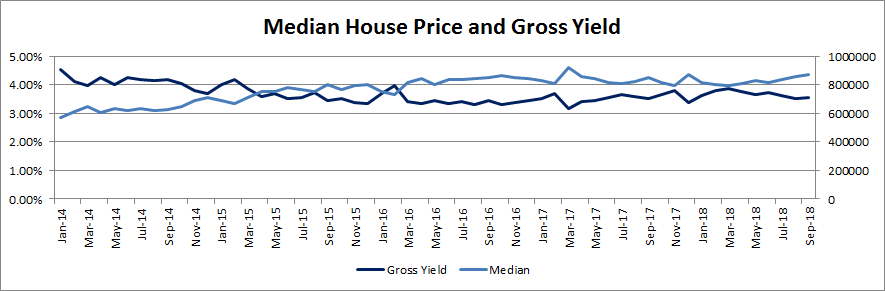

For investors, gross yield is highly reliant on the purchase price of the property as this dictates the rental that can be charged according to market value.

From the the above graph, we see that for 2016 & 2017 there was a flattening of the gross yield mainly due to the flattening of the median house prices. Prior to that we've been seeing declining yield, mostly due to the increase in price being faster than the increase in rent. With the sales prices flattening out and rents continuing to steadily increase, the yield is making up some of its lost ground.

The average rent has continued to increase at a rate of between 2.3% and 6.0%, with an overall increase of 17.5% in the past 5 years.

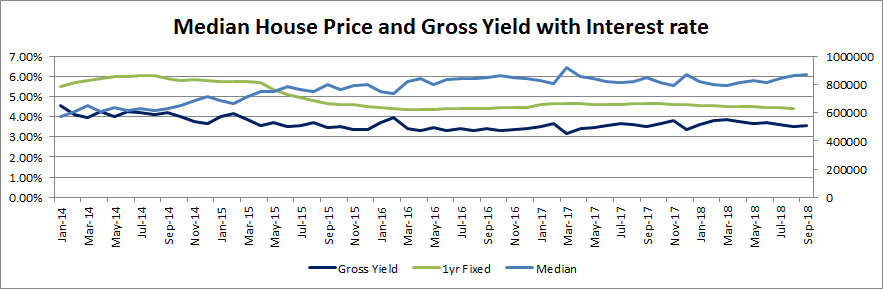

Mortgage rates aren't included in the calculation of gross yield (they are in Nett yield), however with the interest rates dropping currently, the opportunity to increase Nett yields is becoming evident as can be seen from the above graphs.

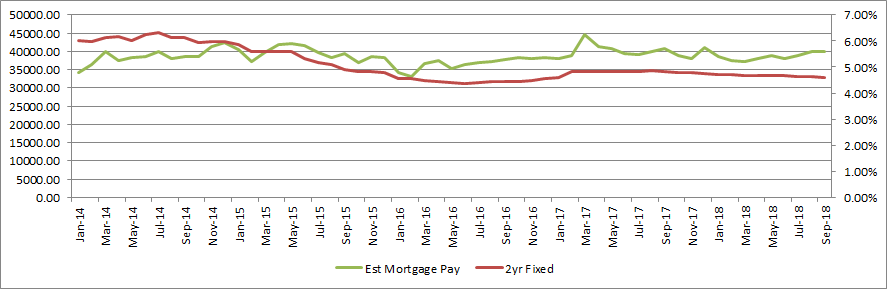

A positive contributor towards increase gross yields can be seen by the drop in interest rates by 25% (from 6.13% to 4.59% for 2 year fixed rates) in the past 5 years.

So, with a decreasing interest rate, is this the right time to consider investing in rental property? It is a better time to consider than the past. Lower interest rates and increasing yields are both positive factors for landlords.

Source :

-

Median from Barfoot and Thompson Analytics for Auckland 3 bedrooms from the given month.

-

Average rent from Barfoot and Thompson Property management statistics.

-

Interest rates from interest.co.nz.

-

Gross yield is calculated annual rental divided by median house price.

-

Estimated mortgage payment median house price is multiplied by 2 year interest rate.