Auckland Property Market Commentary – July 2020

Office market

Pre-COVID-19 the office market had experienced a period of strong growth. Underlying market fundamentals were strong with low vacancy rates in most precincts, rising rents, increasing levels of demand, increased development activity both in the CBD and the metropolitan markets, and steady investor demand. Post COVID-19 lockdown the market outlook has changed significantly. Proposed office building developments have been postponed; the amount of space available for sublease has increased as occupiers have reassessed the amount of space they require. Initial market estimates suggest the amount of sub lease space within the CBD has increased from approximately 30,000 square metres to over 80,000 square metres. Further space is expected to become available over the next six months.

The COVID-19 lockdown appears to have accelerated the adoption of changes in workplace practice. Businesses now appear more flexible and are allowing staff to work from home. This has had the added benefit of reducing congestion and decreasing time employees have spent travelling to and from work. This trend may have some longer term implications for the way in which they organise their staff and could lead to a fall in their office space requirements as staff continue to work remotely post COVID-19.

Over the next 18 months, the forecast COVID-19 driven recession and changes in workplace practice are likely to impact on tenants’ demand for additional office space as they innovate to keep their business operating. The future has become more uncertain, however the office market will recover in the medium term as economic activity bounces back.

Industrial market

The industrial property market has continued to confirm its position as the preferred sector for investors. Pre-COVID-19, the industrial property market’s fundamentals were strong with low levels of vacant space, steady rental growth, the firming of investment yields, a shortage of developable land in prime industrial precincts, and an upswing in development activity which are all the typical characteristics of a late market upswing. Although the sector is likely to face some challenges as a proportion of smaller tenants’ businesses fail, overall demand for space is likely to remain more robust than in the retail and office markets. Well capitalised tenants should be able to trade through the predicted COVID-19 led recession.

Investor demand remains strong for well located properties with strong tenant covenants. High net worth individuals and trusts have been active in the market while those investors requiring significant bank funding have found it harder to get their finance approved. Overall, yields remain stable with investors facing limited other alternative investment opportunities.

Retail Market

The retail sector has experienced significant changes in their operating environment in the first half of 2020. COVID-19 has accelerated consumers’ willingness to shop online. This has placed smaller retailers at a disadvantage to larger operators with established online platforms. Retail spending has rebounded from the levels experienced during the COVID-19 lockdown, however this has not been evenly distributed across all store types and locations.

COVID-19 has had and will continue to have a significant impact on the economy and the size and duration of the impact is unknown. Unemployment is likely to increase and times will be tough for some households which will impact on their retail spend. This creates an uncertain outlook for the retail sector and some retailers will struggle to survive which will have a flow on impact to their landlords. In the medium term the retail sector will recover as economy activity bounces back once the impact of COVID-19 fades.

Property fundamentals for the sector is mixed. Investor demand for well located retail property is likely to remain strong despite the pressure the retail businesses are under. Ongoing regional economic growth, driven in part by strong population growth and increased construction and infrastructure development activity, should support Auckland’s retail property sector in the medium term once the initial impact of the recession has flowed through the market.

Outlook for Auckland region

Pre-COVID-19, Auckland along with the rest of New Zealand had experienced a period of sustained economic growth. However, the economy is now expected to contract by between 5% and 10% in 2020. The size, duration, and distribution of the impact will vary by region. The initial impact is likely to be greatest in regional economies which were over-represented in the tourism, hospitality and accommodation, overseas student education, and retail sectors. Although Auckland will not escape unscathed, the region should perform better than some regions with ongoing population growth and associated consumption supporting activity in the short term.

The outlook for the economy is uncertain; unemployment is expected to double in the short term reflecting softer labour market conditions which is likely to continue to supress consumer confidence and spending in the short term. In the medium term the potential impact of the COVID-19 pandemic on our economy has significant downside risk. The economic performance of our main trading partners is likely to influence how quickly our economy recovers in the medium term. They, unfortunately like New Zealand, are experiencing similar disruption to their economies.

Growth in regional economic activity is expected to continue to increase in the short term and drive further growth in demand for commercial and industrial space in the city. The current low interest rate environment shows no sign of changing in the short term and this should assist in underpinning investor demand.

Property market outlook and sales activity

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property market indicators

|

|

Office Market |

Industrial |

CBD Retail |

|||

|

|

Last 12 Months |

Next 12 Months |

Last 12 Months |

Next 12 Months |

Last 12 Months |

Next 12 Months |

|

Vacancies |

Flat |

Flat/up |

Steady at low levels |

Steady |

Steady at low levels |

Flat |

|

Rents |

Prime Up Secondary Up |

Up |

Up |

Moderate growth |

Steady |

Steady |

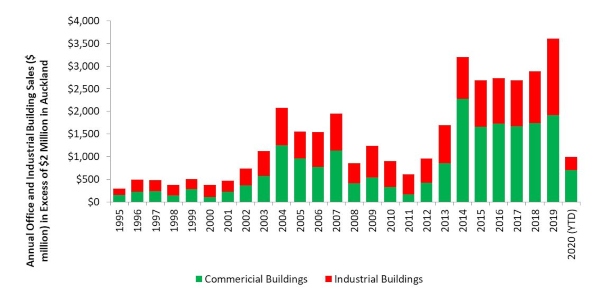

Figure 1 presents the growth in the value of commercial and industrial building sales in the Auckland region with sale prices more than $2 million.

Figure 1: Commercial and industrial building sales (properties selling for more than $2m in Auckland)

The volume of sales activity in 2019 was strong with the volume of sales limited by the number of buildings being offered for sale. Demand in 2020 remains robust for good quality investment opportunities. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

|

Sector |

Yields |

Investor Demand |

||

|

|

Typical Prime Quality Building |

Typical Secondary Quality Building |

Outlook |

|

|

Retail |

4.25% to 6.75% |

4.25% to 6.75% |

Steady |

Mixed |

|

Office |

5.25% to 6.50% |

6.25% to 7.00% |

Steady |

Stable |

|

Industrial |

4.75% to 5.50% |

5.50% to 6.50% |

Steady |

Strong |

Investor demand for good quality property investments is likely to remain robust and once the outlook for the economy becomes more certain, investor activity may increase. At this stage investors appear to be holding onto their existing properties while the market consolidates. Low mortgage interest rates combined with limited alternative investment opportunities are likely to continue to underpin market demand in the short to medium term. Pre-COVID-19 overseas investor demand was strong for higher value property investment opportunities and they may return once the pandemic begins to run its course.

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.