Auckland Property Market Commentary - November 2021

Office market

Auckland’s office market is continuing to weather the COVID-19 pandemic-related lockdowns. Although the sector will experience bounce-back post lockdowns, the longer-term impact on the demand for space is uncertain. The current disruption in workplaces has accelerated the introduction of different ways of working and use of technology. Businesses are reassessing how much office space they actually require and in what locations as they consider the introduction of a variety of work styles and allow staff to work remotely one or more days a week. The full impact of these trends will take time to be reflected in the market statistics. It is difficult to determine the full impact of these trends and their longevity.

CBD office building vacancy rates have increased from historic lows 18 months ago to over 10%. The majority of the vacancy space is in secondary quality buildings. Rents in secondary quality space are under greater downward pressure than higher quality space. Anecdotal evidence suggests where possible, businesses are leasing smaller areas in higher quality buildings for the same or at a lower cost than they previously paid. Current market disruption has also deferred developers progressing some new buildings in the short term which may have medium term supply implications for the market.

The amount of vacant space in the metropolitan office building market has also increased. Vacancy rates have increased across all market precincts due in part to the increased amount of sublease space available. This appears to have stabilised. Like the CBD, demand is strong for Grade A rather than secondary quality space. New and refurbished buildings have leased up with developers offering increased incentives to attract tenants to their space.

Industrial market

The industrial property market has continued to outperform other sectors of the market. Demand for space has continued to outstrip supply over the last 12 months. Supply chain fragility has forced businesses to reassess the robustness of the supply networks and potentially carry additional stock to cope with long term disruptions. This has consequences for the amount and distribution of industrial space required. The outlook for the sector remains robust despite the increased economic uncertainty created by the COVID-19 pandemic.

Market fundamentals remain strong with historically low vacancy rates, increasing market rents and further falls in property investment yields. Strong tenant demand continues to support development activity, although escalation in industrial land values and growth in construction costs are likely to result in developers asking for higher rents to reflect the capital invested. South Auckland has continued to dominate the market for large format retail (large warehouses and distribution/logistics centres) with more industrial service sector businesses growing on the North Shore and West Auckland.

Retail Market

COVID-19 disruption of Auckland’s retail sector has continued with the current level three restrictions in the region. The impact of the restrictions is unevenly distributed across the sector. Operators like supermarkets and those able to adapt to online / non-store sales, have fared better than the hospitality sector and tourism businesses. COVID-19 lockdowns also have an impact on the distribution of retail activity with retailers within the central business areas struggling more than those in suburban locations. Significant numbers of retailers are now negotiating with their landlords and seeking rent relief to offset some of the impact of the COVID-19 lockdown.

The retail property market sector has a diverse range of properties ranging from small single tenant suburban shops to large multi-tenant malls. Market conditions for each of these sub sectors will vary. As Auckland transitions out of the current lockdown, demand for prime leasing opportunities is expected to remain strong. Tenant turnover is likely to increase as some businesses fail to survive the impact of COVID-19. Despite these trends, investor demand is expected to remain robust with yields likely to reflect the strength of the tenant’s covenant.

Outlook for Auckland region

New Zealand’s economy has continued to outperform market expectations and, despite the impact of COVID-19 lockdowns, is now larger than its pre-COVID-19 levels. Growth in economic activity has been driven by strong domestic consumption and increased construction activity which is supported by ever increasing house prices. Low interest rates and rising household incomes have also continued to support economic growth; however, the Reserve Bank has started to tighten the current stimulatory monetary policy settings with their first increase in the official cash rate signalling further increases in this cycle to be likely.

The recent COVID-19 restrictions in Auckland are likely to have resulted in a contraction in the region’s economic activity in the September 2021 quarter. However, household and business balance sheet strength, ongoing fiscal policy support, and strong terms of trade provide confidence that economic activity should recover quickly as alert level restrictions ease. In the near term, Auckland has experienced more and longer COVID-19 related lockdowns than other regions, which will impact on the region’s economic performance. In the medium term, Auckland’s economy is expected to bounce back as restrictions on activity are gradually lifted and the health response to COVID-19 evolves from elimination to suppression once vaccination levels exceed key targets. Auckland’s past reliance on population-led economic growth and associated domestic consumption may limit expansion until the international borders reopen and overseas migration begins to increase.

Property market outlook and sales activity

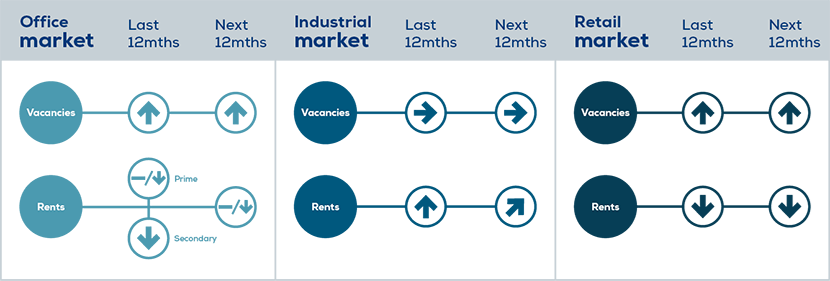

Table 1 presents the trend in key market indicators by market sector.

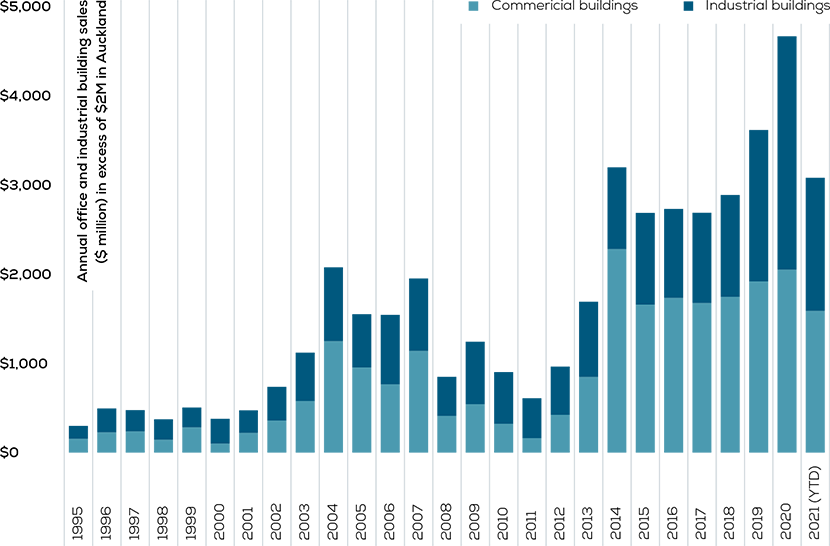

Figure 1 represents the growth in the value of commercial and industrial building sales in the Auckland region with sale prices more than $2 million.

Figure 1: Commercial and industrial building sales (properties selling for more than $2m in Auckland)

The volume of sales activity in the first half of 2021 has been robust with the volume of sales limited by the number of buildings being offered for sale. Demand from investors has continued despite the expectations for higher interest rates, although some investors are taking the opportunity to sell part of their portfolio and taking advantage of the strong market conditions. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

Investor demand for good quality property investments is likely to remain robust and once the outlook for the economy becomes more certain, investor activity may increase. Growing inflation pressures have increased the prospect of higher interest rates in the short to medium term. This may encourage some existing owners to sell, however there are limited alternative investment opportunities available.

Disclaimer:

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report to be correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.