Auckland Property Market Commentary - May 2022

Office market

COVID-19 pandemic restrictions and changes to workplace practices have disrupted the supply/demand dynamics of the office market. Organisations are still working though the implications of co-locational work practices on their office space requirements. Organisations have now had time to adapt and adopt a range of different technologies to allow staff to collaborate whilst working from a number of different locations. In some circumstances this has allowed organisations to reassess the amount of office space they now require and to reconsider the best locations for their office space.

Tenant demand for space in better quality buildings is stronger than for Grade B or lower quality buildings. The net uptake of space within the CBD has been negative for the last two years. The area of occupied space declined by 18,800m² over the last 12 months and the CBD office vacancy rate has increased to 11.7%.

The suburban office market has benefited from increased leasing activity particularly in the Mt Wellington / Southern Corridor precinct and vacancy rates have declined whereas CBD vacancy rates have increased. Demand for space in the Fringe City precinct has also been strong. The net uptake of office space in the year ended March 2022 was +15,800m² and the overall suburban vacancy rate fell to 9.0%. Face rents have eased from the peak in 2019, and landlords are being more proactive by refurbishing space and offering turnkey options to attract tenants.

Despite the change in market fundamentals, investor demand for well let buildings remains strong, particularly from domestic institutions, trusts and high net worth individuals. Yields are now low even though there is a growing expectation of higher interest rates in the future.

Industrial market

Auckland’s industrial market has continued to outperform the other property sectors. Demand for industrial space continues to grow, with limited space available for lease. Demand-side pressures combined with higher land values and construction costs have resulted in rental growth for new builds. Investors remain active in the market with the demand for investment grade buildings continuing to exceed the number available for sale although access to finance and higher interest rates may have an impact in the short to medium term. Although the short-term outlook for the economy is mixed, demand for industrial space is expected to remain strong.

Industrial building vacancy rates have remained near historical lows in all of Auckland’s main industrial precincts. The lack of space available for lease is increasing competition for the limited amount of stock available and placing upward pressure on rents. Tenant demand is also driving ongoing development activity. The rents required by developers to justify the development have increased, driven by higher land values, construction costs and longer development time horizons caused by supply chain problems with building materials. South Auckland has continued to dominate the market for large logistical warehousing and accounted for 67% of all industrial building consents issued in the year ended December 2021. Land values in prime locations have continued to escalate and there is an expectation of a shortage of suitably zoned and serviced developable sites close to major transport networks.

Retail market

The COVID-19 pandemic’s disruption to the retail sector is likely to continue in the short term and the distribution of the impact varies by store format and location. CBD retailing has continued to struggle as office workers continue to use flexible working strategies and overseas visitors have not yet returned. In some locations suburban retailing has experienced a stronger performance benefitting from a redistribution of sales activity.

Total retail sales rebounded in December 2021 after very slow growth in December 2020. Auckland now accounts for 37% of total store-based retail sales activity with total core sales increasing by 9.3% in the December 2021 year after 2.3% growth in the previous 12 months. Sales rebounded with strong growth in clothing and footwear, furniture and floor coverings, hardware, and recreational goods stores. Motor vehicle sales also rebounded. More modest sales growth occurred in food and beverage, liquor, supermarket, and department stores.

New Zealand’s retail sector has continued to evolve and face the challenges resulting from the COVID-19 pandemic. Larger retailers with the systems required to better understand their customers’ preferences and those that have a range of sales channels are likely to continue to perform better than their peers. The hospitality sector has continued to struggle with COVID-19 related restrictions limiting outlet turnover. Although the hospitality sector has struggled, the easing of COVID-19 restrictions and the return of overseas visitors over the balance of 2022 should help their performance.

The retail property market sector has a diverse range of properties ranging from small-single tenant suburban shops to large multi-tenant malls. Tenants’ ability to maintain their outlets and continue paying pre-COVID-19 rents will depend on their ability to adapt to the new trading environment. Despite these trends, investor demand is expected to remain solid. Higher interest rates may place upward pressure on yields. Investors are also likely to focus on opportunities with strong tenant covenants.

Outlook for Auckland region

Over the last two years, Auckland’s economy has borne the brunt of the past COVID-19 restrictions with the longest lockdowns and restrictions on business and household activities. The easing of these restrictions should provide a significant boost for the region’s economy. The closure of our international borders has had a significant impact on Auckland’s population growth which fell in the last year. The fall in the number of people living in Auckland was driven by net domestic migration (New Zealanders moving out of Auckland) exceeding the natural population growth. Residential construction activity in the region remains strong and with current levels of building activity, the supply-side shortages which have plagued the city in the past should be eliminated.

Auckland is the country’s largest city with the biggest manufacturing base and is a key logistics hub. This is not expected to change. Consequently, although short-term performance may be volatile, in the medium-term Auckland’s economy is expected to outperform the rest of the country.

Property market outlook and sales activity

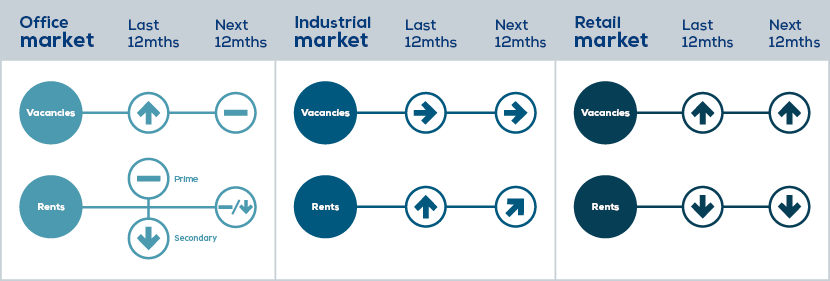

Table below presents the trend in key market indicators by market sector.

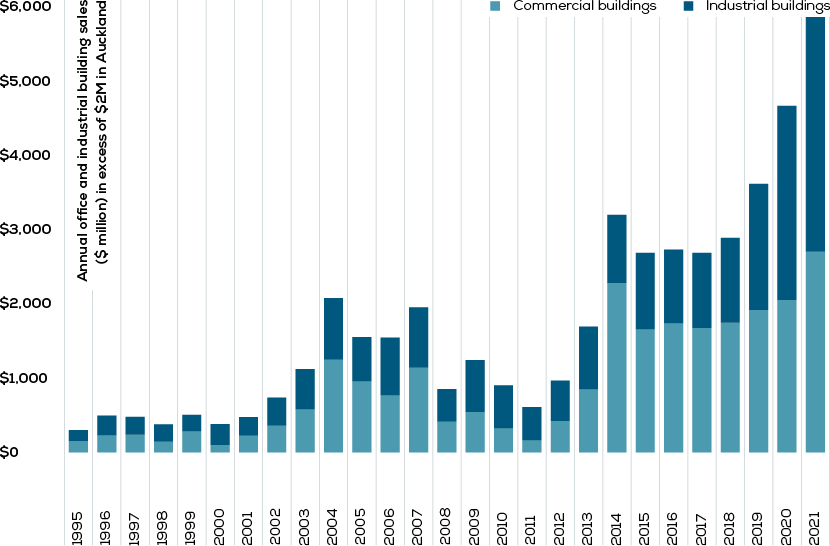

Figure 1 presents the growth in the value of commercial and industrial building sales in the Auckland region with sale prices of more than $2 million.

Figure 1: Commercial and industrial building sales (properties selling for more than $2m in Auckland)

The volume of sales activity in 2021 was robust. Demand from investors has continued despite the expectations for higher interest rates although some investors are taking the opportunity to sell part of their portfolio to take advantage of the strong market conditions.

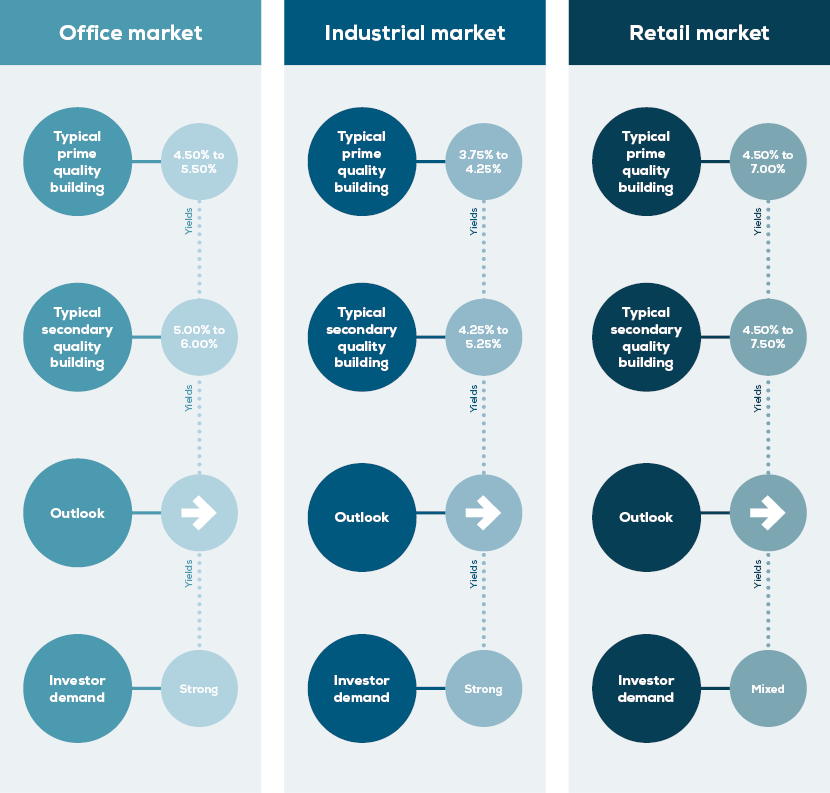

Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

Investor demand has remained robust for well leased buildings in good locations although recent increases in interest rates, combined with tighter lending criteria, has placed upward pressure on yields particularly for lower valued investments.

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.