Auckland Property Market Commentary - October 2025

Outlook for Auckland region

New Zealand’s economy contracted in the first half of 2025 with a 0.9% fall in gross domestic product in the June 2025 quarter. Market expectations are for limited growth over the balance of 2025. Although the outlook is for soft economic growth in the short term, a number of positive factors may benefit the property market going forward.

First, interest rates have continued to fall which should assist in improving business and consumer confidence, support household spending, and increase business activity. In addition, lower interest rates are likely to continue to support investor confidence in good quality property investments. Consumer spending increased a little with the latest statistics showing electronic card spending has increased by just under 2% over the last three months. In addition, government expenditure is likely to increase in the build up to the 2026 election with increased investment on infrastructure and other areas such as health and education.

Although recent labour market statistics have been soft in the first half of 2025, the number of job advertisements has increased slightly, indicating that we may be approaching an emerging turnaround in labour market conditions. In addition, commodity prices are strong, which should support economic activity particularly in the regional centres.

Offsetting these positive drivers is the ongoing uncertainty resulting from international geopolitical factors such as the imposition of tariffs impacting on the strength of our key export markets. Low population growth has also had an adverse impact on the Auckland region’s economy and, when combined with falling house prices, has limited the region’s growth.

Overall, Auckland is the country’s largest region and main economic hub. While economic conditions

have been soft recently, things will improve, as they do in all cycles. We may just be starting to see the first signs that we are near, or possibly at, the bottom of the current cycle.

Office market

Auckland’s office market is continuing to experience challenging market conditions. General economic and business outlook has helped create an environment where prospective tenants lack urgency to commit to leasing deals. Landlords have remained flexible and are prepared to offer tenants turnkey solutions and the opportunity to split floors into smaller tenancies.

The level of incentives offered, particularly for secondary quality space, remains robust with some landlords prepared to offer deals over the cost and ownership of any fitout provided. The tenant flight to better quality buildings has continued in 2025, with businesses optimising the area of space they require, and taking the opportunity to upgrade to better quality buildings while leasing a smaller tenancy footprint. The trend to work remotely for one or more days during the week has continued and businesses have, or are, in the process of adjusting the area of office space they need.

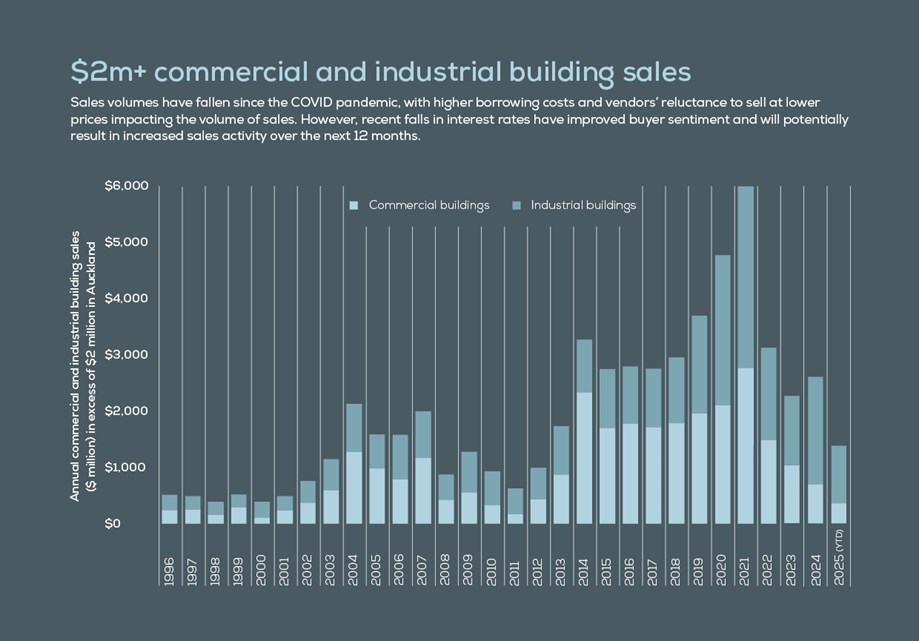

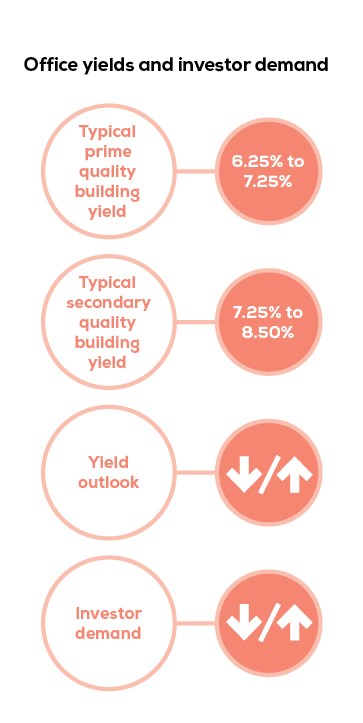

Vacancy rates within the CBD are now 15% up from 14% a year ago. The Metropolitan office market has experienced a similar trend with the overall vacancy rate increasing from 10% a year ago to 11% in September 2025. Despite the increase in vacancy rates, market rents have remained flat over the last year. Investor demand and sales activity have continued to be mixed, with the uncertain economic outlook, high vacancy rates, mixed growth in tenant demand, and limited rental growth all impacting on the volume of transactions. Falling interest rates may assist in boosting market demand for office buildings and place some downward pressure on yields.

Industrial market

The industrial property market conditions have remained firm in the first half of 2025. The steady growth in tenant demand has largely offset growth in supply of new space, with the market only experiencing a small overall increase in the area of vacant space. As a consequence, a significant proportion of the spec industrial buildings previously completed are now occupied.

Landlords have continued to offer some incentives for longer term leases, although they may also require fixed rental increases and bank, rather than personal, guarantees to protect themselves from business failure or tenant default. The number of building consents for industrial premises has remained robust, with 130 consents issued for a total of 361,000m² of space in the 12 months ended June 2025, down from 170 consents with a total floor area of 566,000m² in the previous 12 months. The fall in consenting activity is likely a reflection of the uncertain economic outlook that prevailed during the previous period.

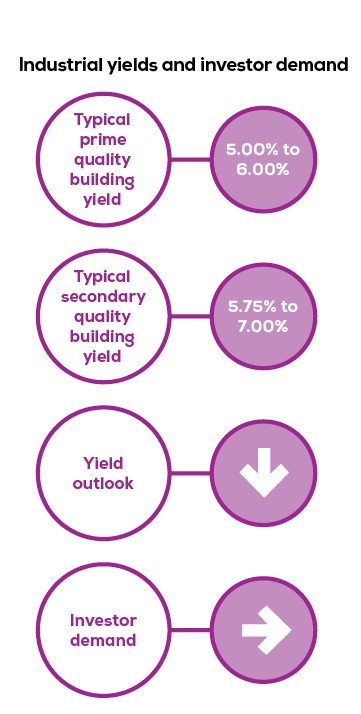

Investor demand for industrial buildings has increased, with a clear preference for well-located assets. Desired specifications include: good truck access, container storage yards, a maximum of 10% to 15% office space, and warehouse space with a stud height exceeding eight metres. Good property attributes are important, as they would assist in releasing the space in the event of any tenant default. The recent falls in interest rates are likely to continue to support investor demand and may place downward pressure on yields.

The market's overall vacancy rate experienced a small increase over the last six months from 2.1% in December 2024 to 2.4% in June 2025. Although the amount of vacant space increased, it remains less than 3% of the total stock, reflecting the strong demand for space and a relatively tight demand/supply balance in

the market.

Retail market

Auckland’s retail market has been impacted by the recent soft economic conditions which have resulted in increased areas of vacant space, particularly in central city strip retail shops. Central city retailers have also had to cope with the disruption caused by the construction of the City Rail Link and negative perceptions associated with the increase in the number of homeless people in the CBD.

Separately, the impact of people working remotely, tight household budgets, and falling house values have also limited retail spend. Outside the CBD, retail performance has been mixed, with some large-format retailers performing better than others and mall performance reflecting general economic conditions.

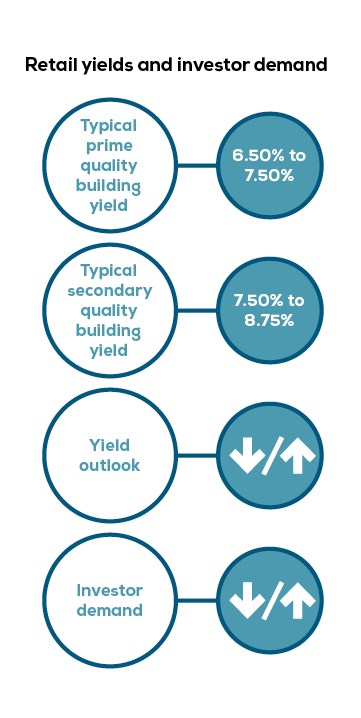

In today’s challenging economic conditions, retailers will need to continue to innovate to maintain their customer base, as they face increased competition from non-store-based retailing from both domestic and overseas companies. The impact of these trends on the retail property market continues to be mixed, with on-going demand for retail space in prime areas and more challenging market conditions in secondary locations.

Our research

The market reports included in this publication have been prepared independently by Ian Mitchell from Livingston and Associates.

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.