Auckland Property Market Commentary - October 2023

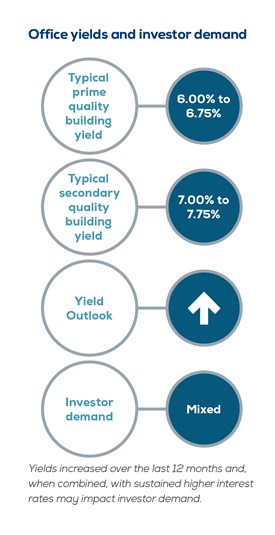

Office market

Auckland’s office markets have continued to evolve over the last six to 12 months. Market conditions remain softer in the CBD with vacancy rates across the whole precinct remaining over 10%.

However, demand for prime quality office space is stronger. Factors impacting on tenant demand include the underlying quality, the building location (with areas closer to the waterfront in higher demand), the building’s environment/sustainability rating, the area of the space being let (with the market for space in excess of 1,000m² being harder to lease), and the flexibility of space to cope with redesign to adapt to changes in work space requirement. For example, the ability to create collaboration spaces and layouts which are more staff friendly.

Post the COVID-19 pandemic, staff’s desire to work from home remains a challenge for some businesses. Business leaders need to balance the desire to attract staff back into the office to increase collaboration between employees whilst still wanting to retain key staff in a low unemployment environment. This has resulted in a number of businesses having more space than they currently require. A proportion of this space may be released back onto the market by subleasing or they may choose to wait for their leases to expire before seeking premises more suited to their needs.

The metropolitan market has stabilised over the last six to 12 months with steady growth in demand. The Southern Corridor office precinct, in particular, has fared better than the central city with tenant demand for space driving vacancy rates to less than 5%. The city fringe precinct has also experienced falls in the amount of vacant space.

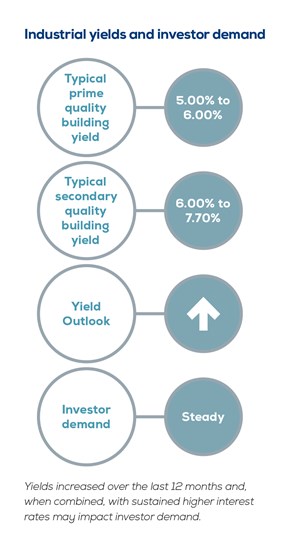

Industrial market

Auckland’s industrial property market has continued its strong performance. Vacancy rates have remained near 1% of the total stock, and tenant demand for space is strong.

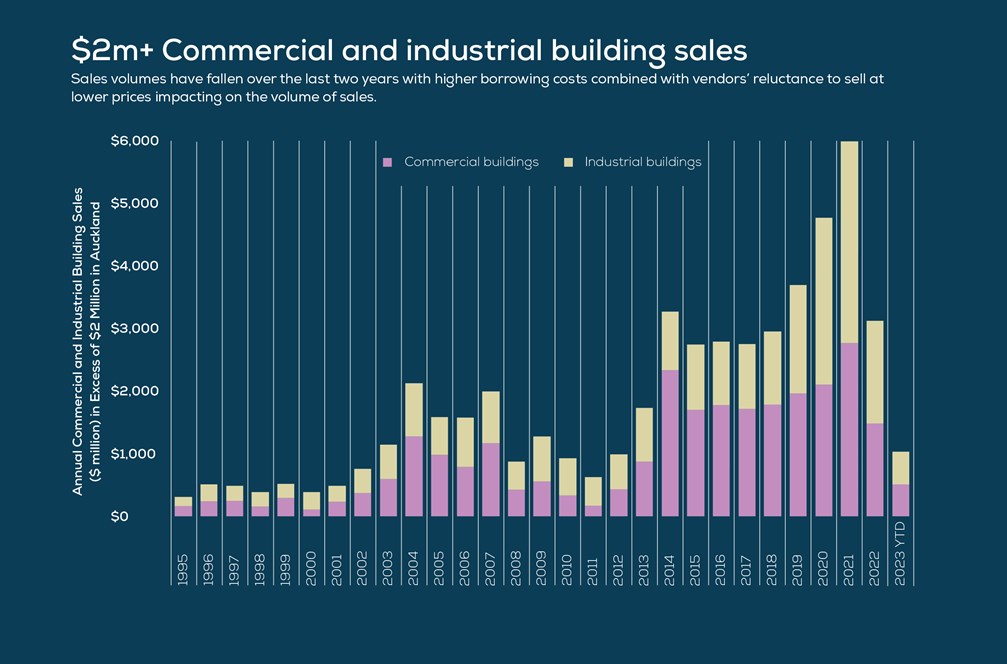

As a consequence, rents have continued to increase and are now in excess of 10% higher than they were 12 months ago. However, investor demand is still strong. It has been impacted by higher interest rates and tightening bank lending criteria which has resulted in higher investment yields. With the realisation that interest rates are likely to remain higher for longer than anticipated, investors will need to ensure they do not breach their bank’s lending covenants to maintain their lender’s support. It is likely banks will work with any distressed investors to ensure an orderly right sizing of their property portfolios.

Demand for new large format space remains steady and there appears to be a decline in smaller speculative development activity. The financial feasibility of development remains challenging with higher interest rates, increased construction costs, elevated land values, and higher investment yields only being partially offset by rental growth over the last 12 months. Building consents, issued in the 12 months ended August 2023, totalled 406.950m² across 176 different projects, down from 489,610m² across 204 projects in the preceding 12 months. This level of development activity is approximately 80% of the pre-COVID-19 peak in 2019. In the August 2023 year, 71% of the consents issued were in South Auckland’s industrial precincts.

The forecast for the sector is mixed (like all property sectors) with an uncertain economic outlook and the expectation that interest rates will remain higher for longer than anticipated 12 months ago. The overall impact of these factors will take time to play out in the industrial property market.

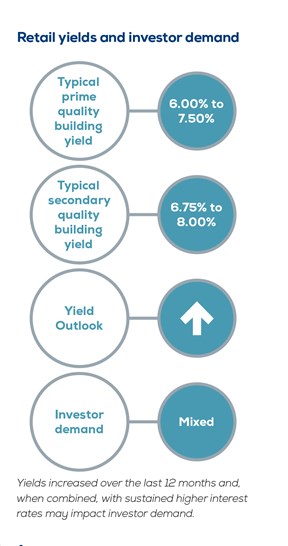

Retail market

Consumer confidence has remained low over the last year. Consumers have been battered by a range of head winds including the realisation that inflation is remaining stubbornly high and, as a consequence, higher interest rates are likely to extend well into 2024.

Higher housing costs resulting from growth in market rents or for owner-occupiers from mortgage interest rate reviews, and increased local body rates, water charges and insurance costs are resulting in more financially stressed households. Wage growth has not increased fast enough to offset these higher costs for a large proportion of households. Despite the change in government, these trends are likely to continue to impact households' propensity to spend.

On a more positive note, the bounce back in the number of overseas visitors to New Zealand will continue to support retail activity. In the 12 months ended August 2023, overseas visitors totalled 2.7 million arrivals. This is approximately 70% of the pre-COVID-19 pandemic peak in 2019. In addition, the general influx of overseas visitors for the 2023/24 cruise ship season is just commencing with over fifty arrivals predicted for the season. These should have a direct impact on central city retailing.

The recent growth in net overseas migration gains should also have a positive impact on the retail sector. In the 12 months ended August 2023, net overseas migration totalled a record 110,250 people. This represents a 2.1% increase in the number of people living in New Zealand before natural population growth is included. Although this is likely to have a positive impact on the retail and construction sector, it would appear unsustainable without significant investment in public infrastructure which successive governments have failed to deliver in the past.

Outlook for Auckland region

New Zealand’s economy grew faster than market expectations in the June 2023 quarter, increasing by 0.9%. Despite the strong growth over the last quarter, the outlook for the next year is for lower growth. This will create a number of challenges for the new National led government as they seek to implement policies that they think will constrain the government's past fiscal excess whilst stimulating future growth. The final mix of their coalition may also impact their ability to change key policy settings.

A number of key economic themes are likely to impact on the performance of the national economy. These include soft growth in the economies of our key trading partners, increased global uncertainties from regional conflicts keeping energy costs higher, stubbornly higher inflation resulting in higher interest rates for longer than previously expected, and a relatively inexperienced right of centre government implementing a range of new policy settings. On a more positive note, the return of overseas tourists and strong population growth driven by record net overseas migration will provide the economy with a boost. Overall, the outlook is for average or below-average national economic growth.

Auckland’s service oriented economy has proven to be more resilient than other regions. Like the rest of the country, short-term performance may be volatile, however, in the medium-term Auckland’s economy is expected to outperform the rest of the country. In addition, the region is likely to benefit more from the recent rebound in the number of overseas visitors and traditionally over half of overseas migrants tend to initially settle in Auckland. If the current level of migration gains continues, this level of population growth will be a major boost for the housing market placing pressure on sale prices and rents. Typically, as the house sale price cycle’s momentum builds, households become more confident and are more likely to increase their consumption benefitting the region’s level of economic activity.

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.