National economic trends

New Zealand’s economy has largely recovered from the impact of the COVID-19 restrictions imposed in 2020. By the end of December 2020, economic activity was only 0.9% smaller than the same quarter in the previous year. The government’s strategy to eliminate COVID-19 has allowed domestic economic activity to rebound post lockdown. A range of economic indicators show strong growth with the falling unemployment rate (now 4.9%) and strong transport sector activity. The distribution of the COVID-19 pandemic restrictions varies by region with those with the greatest exposure to overseas tourism, hospitality and accommodation, overseas student education, and retail sectors being the most effected. GDP growth is expected to be subdued over the next year. Tight border restrictions limiting international tourism is likely to temper future growth while at the same time current monetary policy settings is stimulatory.

Although expectations are for economy activity to continue improving, the overall economic outlook is uncertain. Any new COVID-19 outbreaks would dent future growth and test government’s fiscal ability to provide further targeted subsidies to businesses and households. On a more positive note, national business and consumer confidence has remained robust. Increased government expenditure on infrastructure and housing is expected to support economic growth in the short to medium term. Interest rates have remained near historical lows and with the current loose monetary policy settings, are unlikely to change in the short term. These drivers should continue to underpin our economic performance. The implications of recent housing policy initiatives targeting residential property investors on the housing market is uncertain, as are the implications for wider economic activity. These add to the fog associated with our economic outlook. The economy is expected to recover and grow at a modest pace in 2021. Economy growth is unlikely to return to its “potential” path until our borders reopen.

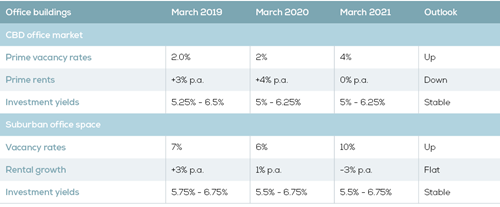

Table 1 presents the trend in key economic indices rates over the last two years.

Table 1: Interest rates

Source: RBNZ, ANZ, and Westpac

In the medium term, Auckland’s regional economy is expected to remain one of the better performing regions in the country. However, in the short term Auckland has experienced more and longer COVID-19 related lockdowns than other regions which will weigh on growth in the Region’s economic activity. Auckland also has a relatively high exposure to the COVID-19 pandemic fallout with its reliance on tourism and international education sectors, and migration led population growth.

Retail property

New Zealand’s retail sector has come under increased pressure with the COVID-19 pandemic disrupting the normal pattern of retail sales. Changes in household spending has redistributed both the location of sales and the type of goods and services consumed. Changes in workplace practices such as people working from home for part of the week, increased online / non-store sales, and households spending money that would have otherwise been used for international travel, have all been key drivers. Total retail sales grew to $97.8 billion in the year ended December 2020, up 0.4% on the previous year and core retail sales (excluding automotive sales, petrol, and servicing) increased by 2.0%. Sales in Auckland Region increased by 2.4% over the same period.

The impact of the COVID-19 pandemic on the growth in retail sales has been unevenly distributed across different store types. Between 2014 and 2019 tourism drove strong growth in accommodation and food and beverage sectors. However, the recent COVID-19 restrictions and border closures have had a dramatic impact on the number of overseas tourists visiting New Zealand. Retailers (particularly in the hospitality and accommodation sectors) reliant on this market have experienced a decline in retail sales. The types of retailers experiencing the strongest growth over the last 12 months include non-store retailing, supermarkets, recreational goods, and electrical goods stores.

Retailers went into the COVID-19 pandemic with fine profit margins and the impact of their profitability has been significant although unevenly distributed by store type. These trends are likely to impact on the level of rents retailers can afford to pay. While some retailers will profit from the changes in sales activity, others may find trading increasingly difficult which could result in increased store vacancies. Retailers may struggle to pay higher rents in the short to medium term which could result in the mix of retailers evolving in some locations. Despite the current trading environment, investor demand for quality stock continues to increase with increased downward pressure on yields.

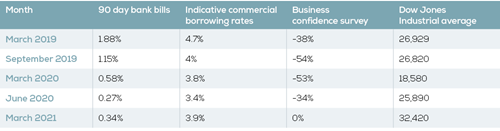

Table 2 summarises key retail property market metrics.

Table 2: Retail property market metrics

NB: COVID-19’s impact on the amount of vacant space and rents is yet to flow through to market statistics.

The retail property market covers a wide range of buildings from small suburban premises, leased to a single tenant, to large integrated malls. Competition for space is likely to remain robust in prime sites and retail outlets, however, the future is more uncertain than in the past. Secondary locations may find it more difficult to let space and tenant turnover may increase as some businesses fail due to the changes in economic conditions. In addition, the distribution of demand for retail space is likely to continue to evolve. Suburban locations are likely to continue to experience growth. However, across the market vacancies are likely to increase, particularly in secondary locations and in the short term, incentives offered as inducements are also likely to become more common. Yields are also likely to reflect the strength of the tenant’s covenant.

Industrial market

Auckland’s industrial market has weathered the impact of the COVID-19 pandemic better than the office and retail markets. Growth in demand from tenants has continued to increase, particularly in South Auckland. Although the short-term outlook for the economy is mixed, demand for industrial space is expected to remain strong.

Investor demand for well-leased industrial buildings remains strong supported by low interest rates and robust investment returns. Tenant demand for space has also continued to increase and development has remained strong. Vacancy rates have increased with development activity outpacing growth in tenant demand. In the year ended December 2020, demand for space in the South Auckland precinct remained near the market’s five-year average whilst net absorption of space in the Auckland Isthmus and on the North Shore was lower than average. South Auckland has continued to consolidate its position as the leading development precinct for large warehouses and distribution centres.

At this stage of the cycle, it would appear tenant demand for industrial space has continued to grow with the COVID-19 pandemic having less impact than on other property market sectors (office and retail). A lack of quality buildings available for lease, and growth in tenant demand for quality new space, is driving ongoing development activity. Land values in prime locations have continued to increase as there is an expectation of a shortage of suitably zoned and serviced developable sites close to the major transport networks. Rents have continued to increase over the last year although the majority of the growth was in the first six months of the year. Limited availability of good quality buildings to lease is driving moderate rental growth.

Low interest rates, combined with investor demand for industrial buildings, has continued to drive increased sales volumes. Although yields have fallen, industrial property returns have outperformed bank deposits. Industrial property investments have increased with steady returns that have continued to outperform office and retail property investments. Industrial building investment returns have continued to consistently outperform other property submarkets (office and retail) in both the short and long-term returns. Industrial investments are expected to remain attractive to investors and as a sector, will continue to provide more consistent returns as COVID-19 impacts our economy.

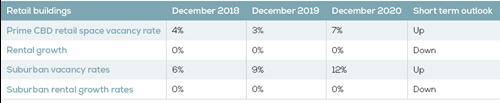

Table 3 presents key industrial property market metrics.

Table 3: Industrial property market metrics

The industrial sector’s strong underlying fundamentals mean it will bounce back once the regional economy begins to recover.

Office market

The office market is continuing to adjust to the impact that the COVID-19 pandemic has had on workplace practices and the flow on effect for the demand for office space both in the CBD and metropolitan office markets. At this stage of the cycle, it is difficult to determine the full impact of these trends and their longevity. However, in the short to medium term the trend to a higher proportion of people working from home and in satellite offices in the suburbs has had a negative impact on the amount of occupied office space. This has resulted in an increase in the amount of sublease space coming onto the market and combined with the completion of a number of new buildings, has resulted in higher vacancy rates both in the CBD and the metropolitan office markets. Despite these trends, investor demand for well let buildings remains robust underpinned by the current historically low interest rates.

The CBD office market is expected to continue to provide investors with moderate returns in the short term. The ability of the market to sustain current yields is dependent on continued strong investor demand, particularly from overseas buyers for the higher value buildings. CBD office rents plateaued over the last six months after a period of steady growth and landlords have started to increase the level of incentives offered. Increased vacancy rates and the ongoing implications of the COVID-19 pandemic plus subsequent changes in workplace practices may place downward pressure on CBD office rents in the short to medium term.

COVID-19 has led to a softening in demand in the suburban office market, although there is considerable variation between the different office market precincts. City Fringe precinct has remained stronger than other locations. Face rents have started to ease, and landlords are now starting to offer higher levels of incentives to attract tenants. The full impact of the implications of changes in workplace practices on the demand for office space and market rents will take time to flow through to market prices. Despite these trends, investor demand for well-leased metropolitan office buildings remains robust, underpinned by the current historically low interest rates.

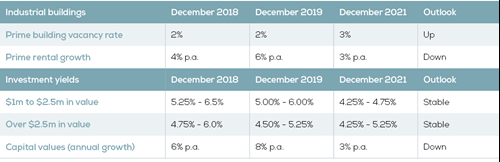

Table 4 presents key office property market metrics.

Table 4: Office property market metrics