May 2018 Auckland Property Market Commentary

Independent market commentary courtesy of Ian Mitchell, Director, Livingston & Associates

Well capitalised investors are still active in the market chasing good quality property investment opportunities with demand still exceeding agents’ ability to source appropriate stock.

The region’s commercial and industrial property market delivered another robust performance over the last 12 months. Strong growth in tenant demand, low interest rates, limited growth in new space, and unsatisfied investor demand for good quality buildings, all combined to deliver solid late cycle results. An overview of the key trends within the market include:

- The CBD office market is expected to continue its solid performance with expectations of further rental growth and strong tenant demand. The market is entering the next stage of its cycle and experiencing typical late cycle activity with increased construction activity, strong rental growth and low vacancy rates. Investor demand is likely to continue to exceed supply. The performance of the metropolitan market varies significantly by precinct. Fringe city market is continuing to experience strong growth. A number of the larger, well capitalised developers are undertaking speculative developments and backing themselves to lease the space prior to completion. Low interest rates combined with strong competition between investors has helped to maintain the current level

of yields.

- Auckland’s industrial market has continued to strengthen and is displaying all the signs of late cycle upswing. Auckland’s robust regional economy has driven a steady increase in occupier demand and this is expected to continue at least in the short term. Growth in demand has continued to place pressure on the amount of stock available to lease. Rents are continuing to increase due to the strong competition for space. Land values for development sites remain high and combined with rising construction costs makes development feasibilities challenging. A number of larger developers are undertaking speculative developments to take advantage of the shortage of good quality modern industrial buildings and capturing higher rents. Whilst there is demand for additional space, banks are becoming more conservative in their lending criteria to developers, making credit harder to access. Investor demand is out stripping the number of properties being offered for sale. Owner occupiers are also active in the market, trying to guarantee they have premises for their businesses and better manage their occupancy costs.

- Retail spending is continuing to increase, supported by ongoing population growth and low interest rates. The short-term outlook is for growth to continue, supported by a modest rebound in the housing market and continued growth in overseas visitors. Although total sales are increasing, the composition of sales growth is changing and continuing to evolve with strong competition between operators. Non-store based retailing grew by 17% over the last year. This is approximately three times the rate of store-based retailing. Online competition from overseas retailers will continue. The impact of these trends on tenant demand for retail property market continues to be mixed. Investor demand for well-located retail building investment opportunities remains strong and yields remain at historical lows.

New Zealand’s economy has continued to expand over the last year. The current economic and business cycle is being supported by accommodative monetary policy, strong population growth driven by high net gains from overseas migration and robust expansion in the tourism sector. Auckland Region has benefited more than most, with above average growth in regional economic activity. The short term outlook is for the region’s economy to continue to grow at above average rates supported by strong population growth and increased spending on infrastructure.

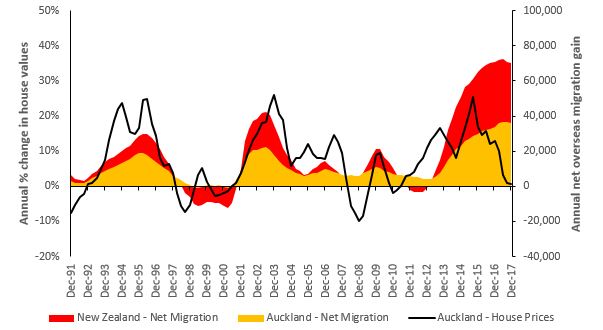

Figure 1 presents the trend in net annual overseas migration combined with Auckland house values growth.

Figure 1: Net Overseas Migration and House Value Growth

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property Market Indicators

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Flat | Up | Steady at low levels |

Steady | Steady at low levels |

Flat |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Steady |

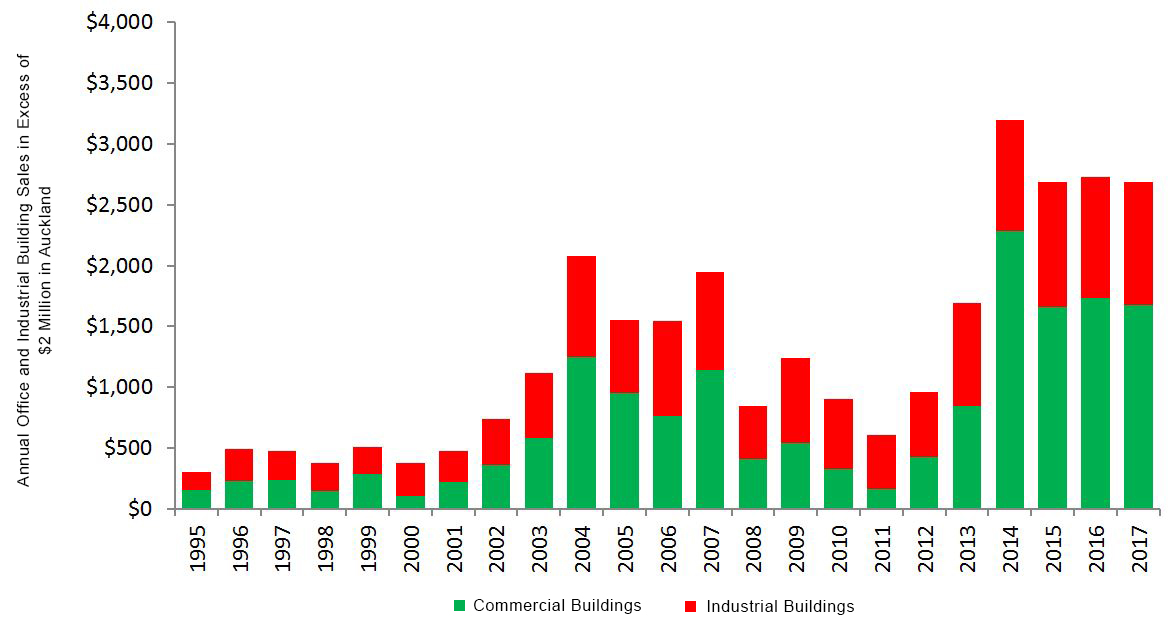

Figure 2 presents the growth in the value of commercial and industrial building sales in Auckland region with sale prices more than $2 million.

Figure 2: Commercial and Industrial Building Sales (properties selling for more than $2m in Auckland)

The volume of sales remains robust with strong competition for modern well leased commercial buildings from a range of investors including syndicators, high net worth individuals, and institutional investors total just under $3 billion in the year ended December 2016. Sales volumes are being limited by the availability of stock being offered for sale and by the ability of some investors to access credit. Low interest rates are still fuelling demand for investments even with the expectation that interest rates are likely to increase over the next two to three years. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and Investor Demand by Sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 4.00% to 7.00% |

4.00% to 7.00% |

Steady | Strong | |

| Office | 5.50% to 6.75% | 6.50% to 7.50% |

Steady | Strong | |

| Industrial | 5.00% to 6.25% |

5.75% to 7.00% | Steady | Strong | |

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.