May 2017 Auckland Property Market Commentary

Independent market commentary courtesy of Ian Mitchell, Director, Livingston & Associates

Well capitalised investors are still active in the market chasing good quality property investment opportunities with demand still exceeding agents’ ability to source appropriate stock.

The availability of credit is starting to impact on some potential purchasers limiting their ability to leverage deals. An overview of the key sectors within the market includes:

- Auckland’s strong economy boosted employment in the office occupying sectors by over 7,000 employees in the last year. This continued to drive the expansion of demand for office space across Auckland. Vacancy rates within Auckland’s CBD are now below 6%. Occupiers have limited options within the CBD which has assisted the growth in demand for space in the fringe city and other suburban office market precincts. The shortage of good quality space has resulted in higher rents. Developers have responded and there is now over 86,000 square metres of space under construction in the CBD and a further 90,000 metres in non-CBD locations. Once these buildings are completed the expectations are that vacancy rates will increase. Yield compression has continued with strong investor demand resulting in further firming of yields.

- The industrial market has also benefited from the regional economies’ growth over the last three years. A significant number of occupiers are operating at full capacity with their premises limiting their ability to grow their business. Vacancy rates in the sector are below 3%, which limits their opportunities to relocate to larger premises. The shortage of space has resulted in higher rents. Developers are starting to respond with increased construction activity. Feasibilities for new space remain tight. Increasing construction costs combined with higher land values for vacant sites have impacted on the rents required to justify new developments. Yield compression has reduced the impact of these higher costs to some extent. The availability of sites for development is tight particularly in mixed use zones with investors looking for the opportunity to purchase sites for residential redevelopment.

- Retail property continues to experience strong demand for space despite the failure of a number of retailers such as Pumpkin Patch and a number of clothing outlets. Occupiers remain optimistic about future performance with the benefits of retail sales growth in the Auckland region exceeding 6% per annum, however being unevenly distributed between store types. Store types supporting the entertainment and tourism sectors as well as residential construction activity have tended to have the highest sales growth over the last year. Ongoing population growth combined with low interest rates and increased house prices should continue to support retail sales growth over the next year. Consumer confidence in Auckland remains strong despite housing costs continuing to increase at a faster pace than household incomes. Investor appetite for retail investments has continued to outstrip supply of properties available for sale and yields continue to firm.

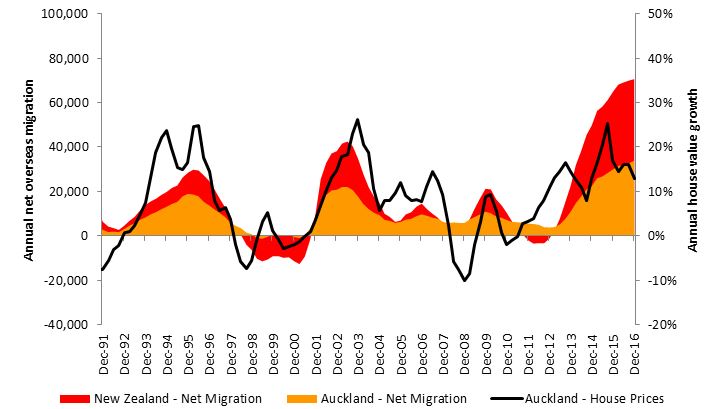

Figure 1: Net Overseas Migration and House Value Growth

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property Market Indicators

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Down | Up | Steady at low levels |

Steady | Steady at low levels |

Flat |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Steady |

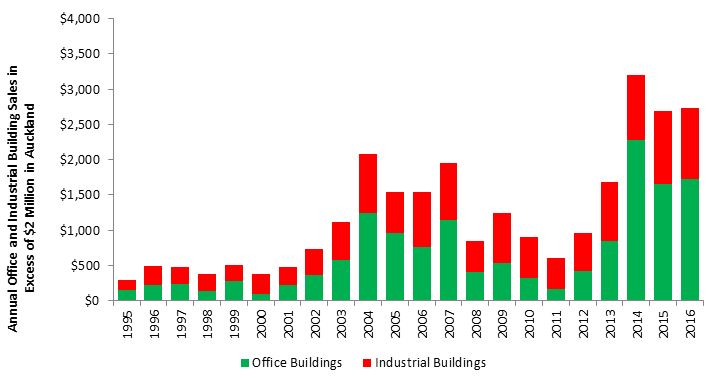

Short term outlook is for current market conditions to continue as Auckland’s strong regional economy boosts employment growth which will continue to drive demand for more space across all three sectors. Figure 2 presents the growth in the value of commercial and industry building sales in Auckland region with sale prices in excess of $2 million.

Figure 2: Commercial and Industrial Building Sales

The volume of sales remains robust with strong competition for modern well leased commercial buildings from a range of investors including syndicators, high net worth individuals, and institutional investors total just under $3 billion in the year ended December 2016. Sales volumes are being limited by the availability of stock being offered for sale and by the ability of some investors to access credit. Low interest rates are still fuelling demand for investments even with the expectation that interest rates are likely to increase over the next two to three years. Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and Investor Demand by Sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 4.00% to 7.00% |

4.00% to 7.00% |

Steady | Strong | |

| Office | 5.50% to 6.75% | 6.50% to 7.50% |

Steady | Strong | |

| Industrial | 5.00% to 6.25% |

5.75% to 7.00% | Steady | Strong | |

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report to be correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.