August 2017 Auckland Property Market Commentary

Strong growth in Auckland’s economy has continued to drive the region’s commercial and industrial property markets. Robust market fundamentals combined with low interest rates have helped maintain investor demand for properties. However, the availability of credit is starting to impact on some potential purchasers limiting their ability to leverage deals.

- Auckland’s strong regional economic growth has resulted in an additional 32,600 employees in the typical office occupying businesses over the last five years. This has increased the demand for office space and resulted in net absorption of 123,000 square metres in the CBD and 114,000 square metres in the metropolitan market over the last five years. Growth in demand combined with low vacancy rates has meant tenants increasingly have had to consider B grade space due to a lack of vacant supply in prime and A grade buildings or alternatively consider fringe city locations. The supply side of the market has started to respond to market pressures. Construction activity has increased as developers look to take advantage of low CBD vacancy rates and ongoing rental growth. There is now 82,000 square metres of office space under construction in the CBD and a further 73,000 square metres under construction outside the CBD. Once completed these buildings will place upward pressure on vacancy rates. Investor demand for good quality stock remains strong.

- The industrial market continues to experience strong underlying market fundamentals with increasing demand, low vacancy rates, increased rents, and strong investor demand. However, some market drivers are starting to change. Anecdotal evidence suggests banks are rationing credit to developers which is impacting on their ability to respond to demand. Land values remain high and combined with growth in construction costs this also means it is difficult for developers to create the additional space required. These are all typical characteristics of a late cycle upswing in market activity. The implications of the Unitary Plan are still flowing through into the market. In areas which have been rezoned Mixed Use, commercial and industrial occupiers are now having to compete with residential developers for buildings. Landlords are now preferring to offer shorter term leases to position themselves so that they can take advantage of any future redevelopment opportunities. Consequently, an increasing number of tenants are looking for owner occupier style opportunities so they can secure premises for their business in the medium to long term.

- Retail property continues to experience strong demand for space with limited space available for lease in prime locations. Ongoing population growth, driven by historically high levels of net overseas migration gains, combined with low interest rates and increased house prices should continue to support retail sales growth although this is unevenly distributed across different store types. Consumer confidence in Auckland remains strong supporting growth in retail sales. Investor appetite for retail investments has continued to outstrip supply of properties available for sale and yields continue to firm.

New Zealand is entering its eighth year of sustained economic growth with growth at its non-inflationary potential. The current economic cycle has been supported by strong population growth which is underpinned by high levels of net inward and overseas migration. New Zealand’s economy grew slightly lower than market expectations in the December 2016 quarter, increasing by 0.4%. Growth in economic activity was boosted growth in the business services, transport, and manufacturing and construction sectors. Strong growth in the tourism sector is also underpinning economic growth. GDP is expected to continue to grow at between 2.0% and 3.0% per annum over the short to medium term. There is growing unease over the unaffordability of Auckland’s housing stock and the long term implications it may have on the sustainability of the region’s economy.

New Zealand is entering its eighth year of sustained economic growth and is expanding at its non-inflationary potential. Key national economic growth drivers include accommodative monetary policy, strong population, and robust expansion in the tourism sector. Auckland region’s economy is expected to continue to grow at above average rates supported by strong migration led population growth (currently 2.8% per annum), ongoing construction activity and infrastructure development, and a robust tourism sector. Strong population growth has also supported significant growth in house values.

Table 1 presents the trend in key market indicators by market sector.

Table 1: Property Market Indicators

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Down | Up | Steady at low levels |

Steady | Steady at low levels |

Flat |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Up |

Short term outlook is for current market conditions to continue as Auckland’s strong regional economy boosts employment growth which will continue to drive demand for more space across all three sectors.

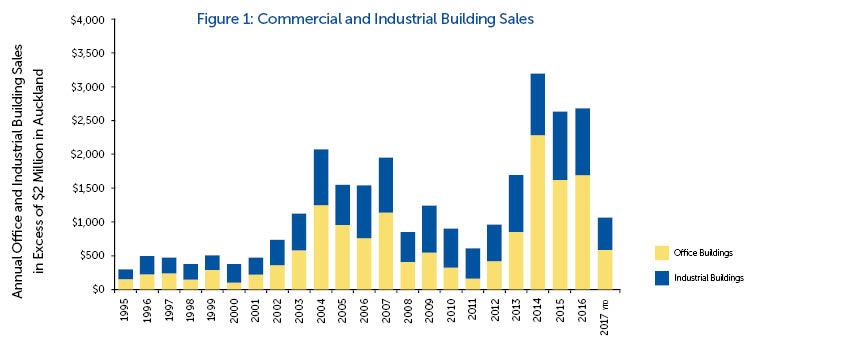

Figure 1 presents the growth in the value of commercial and industrial building sales in the Auckland region with sale prices more than $2 million.

Table 2: Yields and Investor Demand by Sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 4.00% to 7.00% |

4.00% to 7.00% |

Steady | Strong | |

| Office | 5.50% to 6.75% | 6.50% to 7.50% |

Steady | Strong | |

| Industrial | 5.00% to 6.25% |

5.75% to 7.00% | Steady | Strong | |

Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report to be correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.