To grow your property investment portfolio or not - what do the stats say?

For a while, it seemed that the New Zealand real estate industry was collectively holding its breath waiting for announcements on the Capital Gains Tax. Another interesting, while not surprising, development was the latest change in the Official Cash Rate (OCR) which lowered by 0.25% to 1.5%, the lowest in New Zealand history.

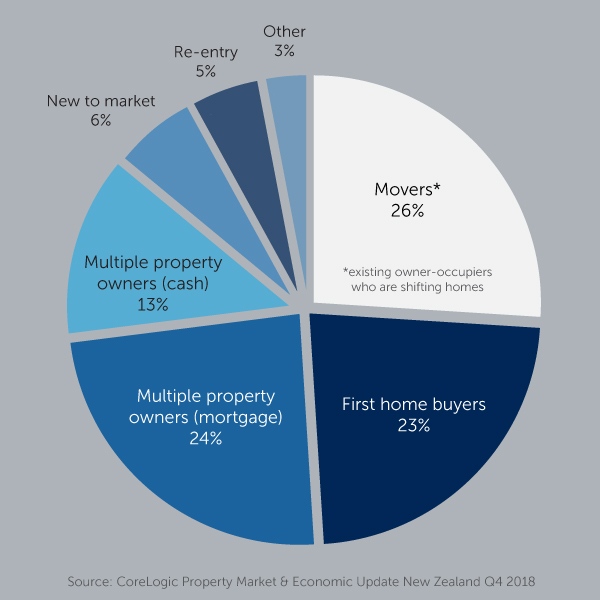

Buyer Classification at a glance across New Zealand

Before we delve into the future, it is important to look at current trends to see where we may be headed. According to recently released data*, regarding Q4 of 2018, the following buyer groups were purchasing properties.

- 26% - movers (existing owner-occupiers who are shifting homes)

- 23% - first home buyers

- 24% - multiple property owner mortgage

- 13% - multiple property owner cash

- 6% - new to market

- 5% - re-entry

- 3% - other

From these numbers and supporting research/data we can glean some keen observations. Going strong at 23% of market activity, it is clear that first home buyers are still finding ways onto the property ladder despite challenges in securing a full down payment. They are achieving this through compromising on things like limited amenities, property age, location and the type of property.

Further, they are helped in that banks can now advance 20% of their owner-occupier to buyers who have not reached a full 20% deposit. While 23% of market activity is a step in the right direction for people wanting to purchase a home, there is obviously still a large pool of people needing rental properties.

The statistics also paint the picture that multiple property owners are hanging tough over time. Sure, investors have seen some challenges with the announcement of the Healthy Homes Standards and other factors such as the tax-ring fence for losses. However, their share of activity has increased two percentage points since 2017 to 37% and they seem to be holding onto their properties with very few altering their portfolio by selling to any major degree. In fact, given that interest rates have lowered and property prices are remaining static, it may be a good time to grow your portfolio.

Leveraging a unique time in the Auckland market

With record low mortgage rates and a cooling Auckland market, it seems like the ideal time for property investors to look to buy. There is still a very solid pool of people seeking desirable rental properties and they are willing to pay a premium for the right one. This is especially true in coveted areas of the city with easy access to the CBD via motorways or public transport. Additionally, landlords willing to make concessions like allowing pets, small renovations or including quality appliances are able to secure much higher rates than similar properties in the same area.

Rate changes are not delighting all investors

To be clear, not everyone is cheering for this reduced OCR. While there are no clear statistics on how many multiple property owners fall into the “Baby Boomer” category, it is safe to assume that they make up a significant portion. Baby Boomers (born from 1944 - 1964), who are landlords, are becoming increasingly vocal about how this is affecting them. Income from short term deposits has decreased for this demographic. Many planned on selling their homes to fund retirement, so this change combined with a cooler market means less fluid cash to live on day-to-day.

Rethinking yield and your return on investment

Historically, when considering whether or not a rental property is worthwhile, the potential buyer would calculate the return based upon historical pricing trends and fluctuation for similar properties in the area. What makes this period unique is that we have seen little movement or significant jumps in property values and sale prices in Auckland recently over a 24-month period. Since properties are slower to appreciate in value investors are instead focusing on the weekly rental income as the return on investment instead of looking to equity and appreciation.

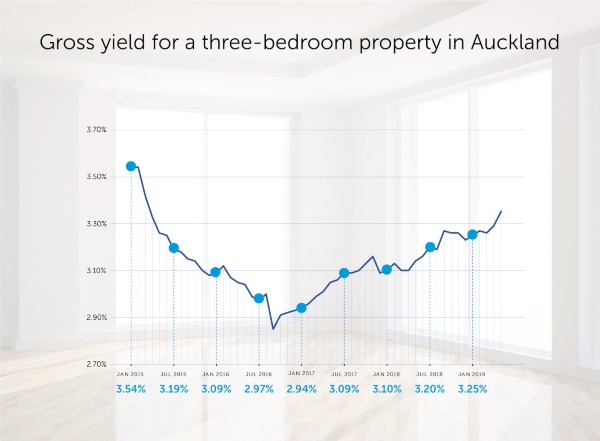

As the graph below reflects, rental yields over time for properties in Auckland are rising. Investors will want to note that current trends indicate that rates are looking to return to those last seen in January 2015 and show no immediate signs of decline.

Investors have realised that relying on increased property values has become a much slower and longer-term investment. In a nutshell, a property’s revenue is being calculated by low mortgage payments combined with higher weekly rental revenue instead of relying on property appreciation over the years. Weekly rental cash flow when combined with lower mortgage rates is how landlords are seeing a return on investment in real time.

*CoreLogic Property Market & Economic Update New Zealand Q4 2018