Auckland gross yields down as house prices continue to go up

With the average price of a 3-bedroom property increasing by 30% over the last 24 months, and rental prices not keeping pace, the average gross yield has decreased by 16%.

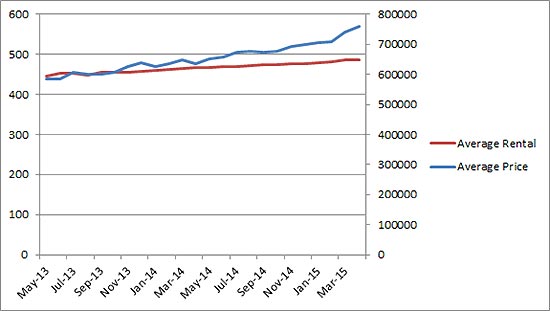

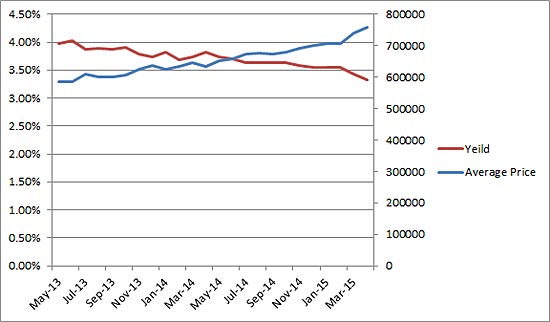

In the past two years, the average price of a 3-bedroom property sold by Barfoot & Thompson has increased by 30%, from 584,526 in May 2013, to $758,960 in April 2015 - an increase of $174,434.

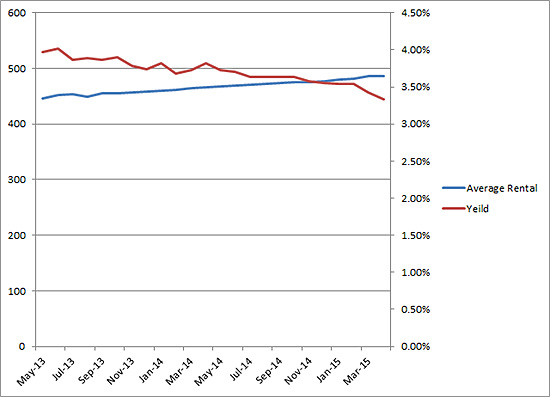

In the same period, the average rental has increased by only 9%, from $446 in May 2013 to $486 in April 2015 - an increase of just $40.

This means that over the past 24 months, the average gross yield has decreased by 16%, going from 3.97% in May 2013, to 3.33% in April 2015.

More market reports

Average rental price vs average sale price

Average rental price vs average yield

Average yield vs average sale price

Understanding rental yield

Yield comes from the rental money received from tenants. It's the rent a property could provide over a year, expressed as a percentage of its purchase price.

Gross yield

This is the income return on your investment before any expenses, outgoings or possible rental vacancies are taken into account. Gross yield does also not take interest rates into account.

Gross rental yield is commonly used when looking at returns, as it is simple to calculate and lets you compare properties with different values and rental returns easily.

Net yield

This is the income return on your investment after any expenses or other outgoings, such as maintenance and insurance, are taken out. Net yield is sometimes referred to as 'rate of return'.

Read our story on how to understand return on investment.