Renting versus buying

Our dedicated in-house statistics team have crunched the numbers. Find out how the cost of weekly interest payments compare to average weekly rental rates in Auckland?

Getting onto the property ladder for the first time in Auckland can be a daunting prospect. Those of us renting wonder whether we are throwing money out the window but at the same time can we realistically afford to buy? Could we instead be paying for our own property instead of contributing towards someone else’s equity as a tenant? Is now the right time for you to become a homeowner? There are many factors and finances to consider.

Renting versus buying - what can you afford?

Let’s explore renting versus owning, at a glance, for 2019 if you combine payments on principal and interest versus average rental rates on a weekly basis. As you can see in the table below, depending on the cost of the property - having a mortgage will cost you more than renting. With that said, the current lower interest rates mean making mortgage payments is not as intimidating as it was in Auckland in the past.

| Mortgage | Rental | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Purchase price | Deposit required | Mortgage | 2 year rate at 1 May 2019 | Annual interest payment | Weekly interest payment only | Weekly payment- 30 yr loan | Average rental for 2 bedrooms | Average rental price for 3 bedrooms | Interest less rent | Mortgage less rent |

| $650,000 | $130,000 | $520,000 | 3.97% | $20,644 | $397.00 | $569.00 | $484.15 | $574.00 | -$87.15 | $84.85 |

| $700,000 | $140,000 | $560,000 | 3.97% | $22,232 | $427.54 | $613.00 | $484.15 | $574.00 | -$56.61 | $128.85 |

| $750,000 | $150,000 | $600,000 | 3.97% | $23,820 | $458.08 | $657.00 | $484.15 | $574.00 | -$26.07 | $172.85 |

| $800,000 | $160,000 | $640,000 | 3.97% | $25,408 | $488.62 | $701.00 | $484.15 | $574.00 | $4.47 | $216.85 |

| $830,000 | $166,000 | $664,000 | 3.97% | $26,360.80 | $506.94 | $727.00 | $484.15 | $574.00 | $22.79 | $242.85 |

First-time buyers are usually able to afford, and are more keen to purchase on the lower end of what is termed “median-priced” properties that begin at $800,000. For instance, given current interest rates if you buy a home for $800,000 you will need a $160,000 deposit and your weekly payments (which includes interest and principal) will be approximately $701. A three-bedroom rental in Auckland runs around $574 per week. A mortgage on an $800,000 property will cost you approximately $127 per week (or $508 per month) more than renting. However, even though the mortgage means paying more, you are indeed building equity in your own property.

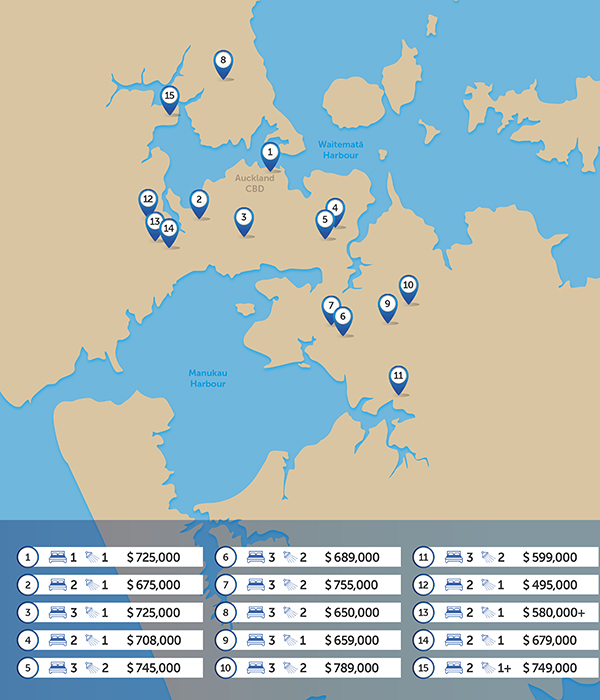

Median-priced and lower-quartile purchasers (homes priced at around $650,000) may have to sacrifice on things like location, the type of property as well as the age and condition of the property. That does not mean there aren’t gems out there just waiting for you to take a tour. Worth noting as well, is that new construction, vacant land and buying off the plans often requires less of a deposit - as little as 10% in some cases. Let’s see what you can purchase for specific amounts around Auckland in this range based on recent Barfoot & Thompson listings.

The statistics and maths at a glance paint a more practical picture of what payments would look like. It's good to also note that many major lenders have online mortgage calculators so you can play around with the numbers. With interest rates this low, it would be a shame not to at least do a comparative search of what is on the property market that may be within your reach.

In selecting examples of properties the following criteria were considered :

1. First Home Buyer options based on the following price points:

· The lower quartile price for the Auckland region is $651,000

· The median house price is $830,000

· The average house price is $930,000

2. Suburbs based on the average price of less than $800,000 for a 3-bedroom house within the last 6 months (apart from the central city).

| Map No. | Area | Example of property |

|---|---|---|

| 1 | City | New 2-bedroom apartment on Anzac Ave - $725,000 |

| 2 | Avondale | New 2-bedroom apartment from $675,000 |

| 3 | Mt Roskill | Brick and tile renovated unit (3-bedroom, 1-bathroom) - $725,000 |

| 4 | Mt. Wellington | New 2-bedroom apartment - $708,000 |

| 5 | Mt. Wellington | Standalone 3-bedroom, 2-bathroom on 480m2 - $745,000 |

| 6 | Papatoetoe | Standalone 3-bedroom, 2-bathroom with garage - $689,000 |

| 7 | Papatoetoe | Standalone 3-bedroom, 2-bathroom - $755,000 |

| 8 | Glenfield | 3-bedroom, 2-bathroom with garage standalone house |

| 9 | Flat Bush | 3-bedroom,1-bathroom townhouse - $659,000 |

| 10 | Flat Bush | 3-bedroom, 2-bathroom brick duplex - $789,000 |

| 11 | Papakura | 3-bedroom, 2-bathroom with one-car garage |

| 12 | Henderson | 2-bedroom,1-bathroom, brick and tile home |

| 13 | Glen Eden | New 2-bedroom,1-bathroom house from $580,000 to $680,000 |

| 14 | Glen Eden | 2-bedroom,1-bathroom standalone house |

| 15 | Hobsonsville | New 2-bedroom,1-bathroom, plus study townhouse on 94m2 - $749,000 |

Please note:

- This two-year fixed rate average is based on information from interest.co.nz.

- Individual homes may no longer be listed as this is merely to showcase the types of properties within the suggested first-time home owner price range.