April 2016 Auckland Property Market Commentary

Independent market commentary courtesy of Ian Mitchell, Director, Livingston & Associates

Auckland’s property markets have continued to strengthen over the last twelve months.

An overview of the key sectors within the market includes:

-

Auckland’s CBD office market has continued to strengthen over the last year. Growth in tenant demand for space in the central city has resulted in a fall in vacancy rates. There is now very little good quality space available for lease. The majority of the vacant stock is concentrated in older, secondary quality buildings. The fall in vacant space has resulted in increases in net effective rents with mid-market quality buildings also experiencing rental growth. Strong investor demand for the limited number of buildings being offered for sale has also put downward pressure on yields. Market returns from office building investments are above their long term average.

-

The industrial market has continued to go from strength to strength over the last twelve months. Demand from occupiers has continued to push down vacancy rates and good quality vacant stock is becoming increasingly difficult to find. As a result, prime rents have started to increase and are rapidly approaching levels experienced at the peak of the 2007/2008 cycle. Land values have continued to increase and development sites cost $350 to $400 per square metre in established areas. Demand for new modern premises continues to be unsatisfied.

-

Demand for retail space has been mixed over the last year with vacancy rates falling in some locations whilst others experienced an increase. The mixed growth in tenant demand contrasts with strong fundamentals with retail sales increasing by 7.1% per annum in Auckland, low interest rates and strong consumer confidence and population growth. Competition for sales will be strong with online competition from both domestic and overseas businesses. At this stage of the cycle, investor demand is expected to continue to exceed the number of properties available for sale and continue to place downward pressure on yields.

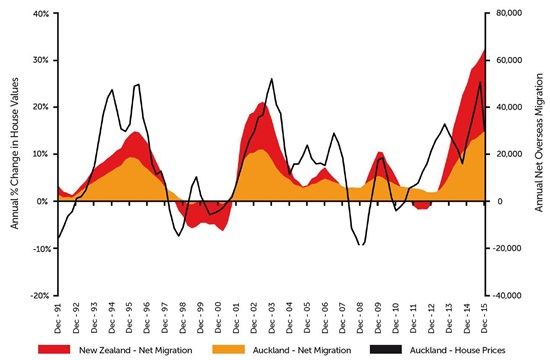

Figure 1 presents the trend in net annual overseas migration gains nationally and for Auckland region combined with the annual growth in Auckland house values.

Figure 1: Net Overseas Migration and House Value Growth

Auckland’s economy is expected to continue to grow and out perform the national growth rate.

Population growth in excess of 3% per annum, increased construction activity, growth in tourist arrivals, and low interest rates all support the continued expansion of the local economy.

The growth in Auckland’s economy will continue to drive growth in commercial and industrial property markets.

Table 1: Property Market Indicators

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Down | Down | Down | Down | Down | Flat |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Steady |

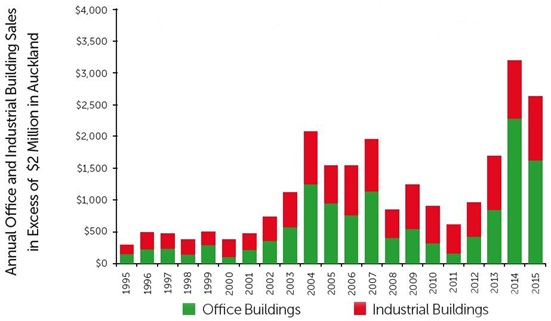

Figure 2 presents the growth in the value of commercial and industry building sales in Auckland region with sale prices in excess of $2million.

Figure 2: Commercial and Industrial Building Sales (properties selling for more than $2m in Auckland)

The volume of sales during 2015 was down from the peak in 2014 however continued to exceed the long term average.

The volume of sales was limited by a lack of stock rather than investor demand or access to credit.

The challenge associated with sourcing sufficient good quality property investments in Auckland has increased investor interest in Wellington and provincial centres.

The strong competition for the stock offered for sale has placed downward pressure on yields.

Table 2: Yields and investor demand by sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 5.00% to 7.50% |

5.00% to 8.00% |

Steady | Strong | |

| Office | 6.25% to 7.00% | 6.75% to 7.75% |

Steady | Strong | |

| Industrial | 6.00% to 6.50% |

6.25% to 7.00% | Steady | Strong | |

Yields reflect the very competitive nature of the current property investment market.

Yields for buildings with values of less than $2 million with good leases reflect the premium some investors are prepared to pay, particularly in the current low interest rate environment.

In the short term, strong investor demand combined with robust property market fundamentals will continue to support market values.

In the medium term, the future direction of interest rates and liquidity on world markets will have a significant impact on our capital markets.

Please note: Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.