April 2015 Auckland Property Market Commentary

Independent market commentary courtesy of Ian Mitchell, Director, Livingston & Associates

Auckland’s commercial and industrial markets continued to improve during 2014 and early 2015.

Demand from occupiers continued to increase, and this combined with the limited amount of development activity over the last two years resulted in falling vacancy rates and moderate rental growth in most sub-markets.

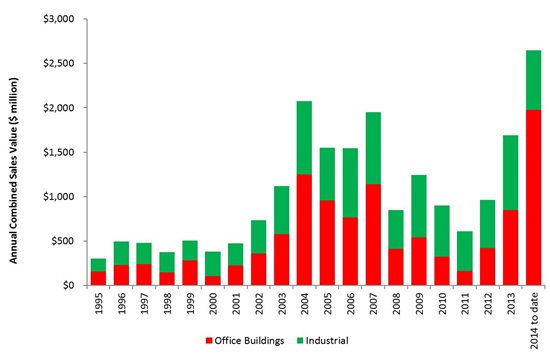

Investor demand has also been strong with the volume of sales during 2014 exceeding the value of annual sales at the peak of the last cycle in the mid-2000s.

This robust market performance is a result of ongoing growth in regional economic activity, strong population growth, low interest rates, and readily available credit.

An overview of the key sectors within the market includes:

- CBD office market significantly improved during 2014. The amount of space available to lease fell as demand increased. Vacancy rates are now over 3.5 percentage points lower than they were in March 2013. Short term market performance looks set to continue to improve with demand expected to increase during 2015 and limited development activity will result in more rental growth. Demand for good quality office buildings is stronger than the ability of agents to source suitable stock. As a consequence office building yields remain under downward pressure.

- The industrial market continued to strengthen during 2014 and the first quarter of 2015. Demand for space continued to increase over the last year and vacancy rates fell by over two percentage points. Development activity has started to increase in response to the increased demand. Industrial investment has continued to be favoured by investors due to their good return profiles.

- The sub $2 million retail market continues to perform strongly. Quality investment stock is in short supply and yields are lower than investment fundamentals suggest. The occupier market has not been as robust as the investment market with some retailers struggling to maintain their margins. Larger retail investment properties have also sold well over the last year.

Migration gains drive growth

Strong overseas net migration gains have been one of the factors driving growth in Auckland’s economy during 2014. Auckland's economy is expected to continue to grow at a faster rate than the national economy during 2015.

Strong net migration gains combined with growth in the construction sector should assist in underpinning Auckland’s economy during 2015 and drive growth in the commercial and industrial markets.

Table 1 presents the trend in key market indicators by market sector.

Table 1: Key market indicators by market sector

| Office market | Industrial | Retail | ||||

|---|---|---|---|---|---|---|

| Last 12 months | Next 12 months | Last 12 months | Next 12 months | Last 12 months | Next 12 months | |

| Vacancies |

Down | Down | Down | Down | Down | Down |

| Rents | Prime up Secondary up |

Up | Up | Up | Steady | Steady |

Volume of sales higher

Sales during 2014 were higher than at the peak of the last cycle in the mid-2000s. The volume of sales activity is underpinned by low interest rates, institutions reconfiguring their portfolios to fund development activity, lack of other suitable investment opportunities and the return of overseas investors particularly from Asia.

Growth in value of commercial and industry building sales in Auckland Region with sale prices in excess of $2 million

Demand outstrips supply

Confidence in Auckland’s commercial and industrial property investment market remains robust. Investor demand continues to outstrip the supply of quality investment stock. It is unlikely that the current volume of sales will continue in 2015 due to a lack of stock for sale.

Investors targeting the lower value end of the market are also active. These investors typically target retail and industrial properties as their favoured investment sectors.

Anecdotal evidence suggests investors may be under-pricing the risk associated with smaller as yields have continued to fall.

Table 2 summarises current yields by sector, their outlook over the next six months and the level of investor demand.

Table 2: Yields and investor demand by sector

|

Yields

|

|||||

|---|---|---|---|---|---|

| Sector | Typical prime quality building |

Typical secondary quality building |

Outlook | Investor demand | |

| Retail | 5.00% to 7.50% |

5.00% to 8.00% |

Steady | Strong | |

| Office | 6.50% to 7.25% | 7.00% to 8.25% |

Steady | Strong | |

| Industrial | 6.50% to 7.25% |

7.00% to 8.25% | Steady | Strong | |

Strong demand for property investments

Yields continued to fall during 2014 and are now at least 100 basis points lower than they were two years ago. The fall in yields reflect the strong demand for property investments, the liquidity in the banking sector, and the low cost of credit.

Current market sentiment is that interest rates are unlikely to increase in the short to medium term. This has continued to flow through to investor confidence.

In the short term strong investor demand combined with improving property market fundamentals will continue to support market values.

In the medium term, the future direction of interest rates and liquidity on world markets will have a significant impact on our capital markets.

Please note: Every effort has been made to ensure the soundness and accuracy of the opinions, information, and forecasts expressed in this report. Information, opinions and forecasts contained in this report should be regarded solely as a general guide. While we consider statements in the report are correct, no liability is accepted for any incorrect statement, information or forecast. We disclaim any liability that may arise from any person acting on the material within.