New lease accounting standard

Calling all commercial property owners, purveyors, lessors and lessees: you will all need to be familiar with significant changes to how leases are currently accounted for in financial statements – even if you have no direct accounting responsibilities.

This year, large companies (particularly if they are lessees) will have to implement updated accounting standards that significantly change the status quo.

Why?

Financial reporting standards are regularly reviewed to ensure that they’re still fit for purpose; leasing has been identified as an area that could be improved because the current standard has been in place for over 25 years.

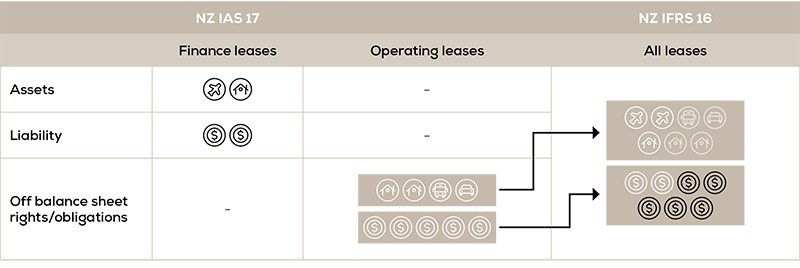

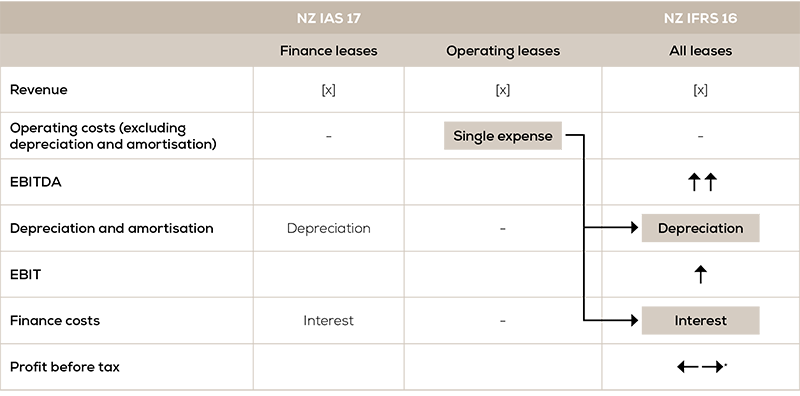

Put simply, your current financial statements will almost certainly display a lease expense line item in the profit or loss statement if you have any contractual arrangements that have been classified as operating leases. The notes to your financial statements (and not on your balance sheet) then disclose what your unexpired gross contractual leasing obligations are after your balance date.

However, in this year’s financial statements because a new accounting standard on leasing comes into effect, your organisation is obligated to record the discounted value of your future leasing obligations in the balance sheet, and “right of use” assets will also need to be recognised for the first time; these being the assets your business controls during the leasing contract period.

How?

The challenge many organisations are now grappling with is gathering all of the relevant facts and figures to complete the necessary calculations so that they can transition from the old leasing standard (NZ IAS 17) and comply with the new standard (NZ IFRS 16).

There are two ways you can transition to the NZ IFRS 16.

- The Fully Retrospective Method (FRM)

This method requires all the new accounting principles to be applied on a “look-back” basis. This means restating comparatives and this method offers no practical expedients to make transition easier. The FRM takes a lot more time and effort to complete but should be adopted if leasing is critical to your business operations, and your shareholders, investors and bankers assess your operational performance based on comparative figures. - The Modified Retrospective Method (MRM)

The MRM approach is much easier to apply because it has six practical expedients to ease the burden of changing from the old to the new standard, including not having to restate any comparatives. Experience with the new standard is indicating strongly that every practical expedient concession should be considered as it could save a lot of time and effort. However, the MRM still requires estimates and judgements to be made by management, many of which have to be disclosed in your financial statements in considerable detail.

Balance sheet – recognising leasing rights and obligations for the first time under the replacement standard

Profit or loss – how various line items will need to change if you are a lessor

NZ IFRS 16 is a complex standard to apply. One of the biggest traps we have found to date is assuming that every lease that is currently being accounted for under the old standard (NZ IAS 17) automatically comes across into the new standard.

Particular care and attention needs to be given to all the definitions (as well as the practical expedients of MTM if you’re applying this method). If they are overlooked or misinterpreted, this may lead to incorrectly applying the requirements of the new standard which could result in fines and penalties imposed by the Registrar of Companies for non-compliance with the financial reporting requirements set out in applicable legislation.

Other potential pitfalls that exist within the body of the replacement standard include:

- Assessing the likelihood of renewing the lease

- Termination clauses

- Lease roll-over implications

- Lease payment variations

- Residual value guarantee payments

- Purchase option payments

- Lease payments that are denominated in a foreign currency

- Correctly calculating the incremental borrowing rate

- Sale and leaseback arrangements

- Revaluing the “right of use asset” along similar lines to owning the asset in its own right (e.g. land and buildings)

- Impairment

- Removal and restoration costs, to name just a few

This new lease accounting standard came into effect for large companies and partnerships and applies to any accounting period beginning on or after 1 January 2019, so it should be considered now.

All the details can be found in the replacement accounting standard for leases, called NZ IFRS 16 Leases.

Ultimately, company directors will need to select the leasing transition method that is most appropriate for their business. If you have several leases, to ease the burden of change there are now a few lease accounting software solutions that you can use, but they are dependent on a complete set of variables being gathered from the outset, so if you have not already done so, make sure you consider your leasing arrangements sooner rather than later.

Author: Mark Hucklesby Partner & National Technical Director, Grant Thornton New Zealand. Call +64 21 664 585 or email Mark

Mark is the firm’s financial reporting expert. For many years he has either been creating, interpreting or commenting on financial reporting and auditing standards, including this new standard. He is currently a member of the External Reporting Board’s Accounting and Audit Technical Reference Group.