Sublease space is changing the Auckland office leasing market

Over the past 12 months the amount of sublease space in the Auckland office leasing market has increased 326% from 32,190m² to 104,942m².

45.2% of the sublease space is in the Auckland CBD with the balance split between the North Shore (19.3%), City Fringe (21.9%) and Southern Corridor (13.6%).

The number of tenancies available has increased from 42 to 103 with an average tenancy size now at 1,027m².

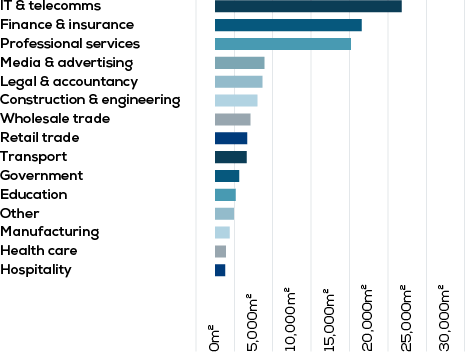

The largest contributors to the increase in sublease space have been companies in the following industries:

Professional services – 17,666m²

Finance and insurance – 19,084m²

IT and telecommunication – 24,270m²

Combined, these three categories account 58% of the current sublease office space.

The clear driver for this increase has been the rapid adoption of staff working from home through COVID-19 and the trend seems here to stay with larger occupiers such as Vodafone putting 50% of their office space up for sublease.

It is interesting to see these larger occupiers who made longer term 12 plus year strategy decisions only 3 to 5 years ago, now moving in a whole new direction.

Most companies that Barfoot & Thompson Commercial are working with now lease 20%-50% less space than they would have in 2019, however there is still a flight to quality where companies will move to a better building but in a smaller footprint.

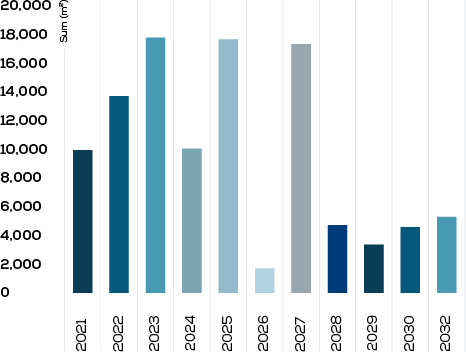

The expiry profile over the next 10 years shows that 39% of the total m² for sublease is coming up for lease expiry in the next three years being 41,289m².

The expiry profile of the current office sublease space is shown below:

Only time will tell if working from home is a fad or not. For many companies the jury is still out on whether you can effectively maintain a culture, facilitate collaboration and generate productivity with staff working remotely.